Columbia Sportswear 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our Common Stock Price May Be Volatile

The price of our common stock has Öuctuated substantially since our initial public oÅering. Our common

stock is traded on the Nasdaq National Market, which has experienced and is likely to experience signiÑcant

price and volume Öuctuations that could adversely aÅect the market price of our common stock without regard

to our operating performance. We also believe factors such as Öuctuations in Ñnancial results, variances from

Ñnancial market expectations, changes in earnings estimates by analysts, or announcements by us or

competitors may cause the market price of the common stock to Öuctuate, perhaps substantially.

Insiders Control a Majority of Our Common Stock and Could Sell Shares

Timothy Boyle, Gert Boyle and Sarah Bany (Gert Boyle's daughter and member of our Board of

Directors), beneÑcially own a majority of our Common Stock (approximately 65 percent as of December 31,

2001). As a result, if acting together, they will be able to eÅectively control matters requiring shareholder

approval without the cooperation of outside shareholders. Shares held by these three insiders are available for

resale, subject to the limitations of Rule 144 under the Securities Act of 1933. The sale or prospect of the sale

of a substantial number of these shares could have an adverse aÅect on the market price of our Common

Stock.

Item 7(a). Quantitative and Qualitative Disclosures about Market Risk

The information required by this item is included in Management's Discussion and Analysis of Financial

Condition and Results of Operations and is incorporated herein by this reference.

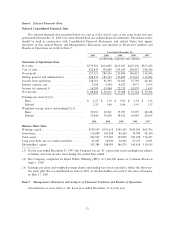

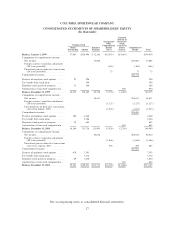

Item 8. Financial Statements and Supplemental Data

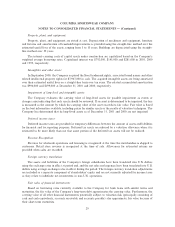

Our management is responsible for the information and representations contained in this report. The

Ñnancial statements have been prepared in conformity with accounting principles generally accepted in the

United States of America, which we considered appropriate in the circumstances and include some amounts

based on our best estimates and judgments. Other Ñnancial information in this report is consistent with these

Ñnancial statements.

Our accounting systems include controls designed to reasonably assure that assets are safeguarded from

unauthorized use or disposition and which provide for the preparation of Ñnancial statements in conformity

with accounting principles generally accepted in the United States of America. These systems are supple-

mented by the selection and training of qualiÑed Ñnancial personnel and an organizational structure providing

for appropriate segregation of duties.

The Audit Committee is responsible for recommending to the Board of Directors the appointment of the

independent accountants and reviews with the independent accountants and management the scope and the

results of the annual examination, the eÅectiveness of the accounting control system and other matters relating

to our Ñnancial aÅairs as they deem appropriate.

22