Columbia Sportswear 2001 Annual Report Download - page 23

Download and view the complete annual report

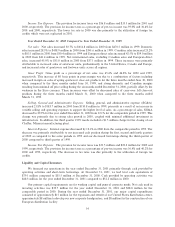

Please find page 23 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.legal tender until January 1, 2002. On this date, Euro-denominated bills and coins were issued for use in cash

transactions.

All systems have been converted and are Euro compliant. We did not experience any signiÑcant

operational disruptions during the implementation of the Euro. In addition, we did not incur any material costs

from the implementation of the Euro.

Recent Accounting Pronouncements

In June 2001, the Financial Accounting Standards Board (""FASB'') issued Statement of Financial

Accounting Standards (""SFAS'') No. 142, ""Goodwill and Other Intangible Assets.'' The statement

eliminates amortization of goodwill and certain intangible assets with indeÑnite useful lives and instead sets

forth methods to periodically evaluate these assets for impairment. SFAS No. 142 becomes eÅective for the

Company beginning January 1, 2002. Management has evaluated the impact of the adoption of SFAS No. 142

and has determined that this standard will not have a material impact on the Company's Ñnancial position or

the results of operations.

In August 2001, the FASB issued SFAS No. 144, ""Accounting for the Impairment or Disposal of Long-

Lived Assets.'' SFAS No. 144 establishes a single accounting model for long-lived assets to be disposed of and

replaces SFAS No. 121, ""Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to

Be Disposed Of,'' and APB Opinion No. 30, ""Reporting Results of Operations Ì Reporting the EÅects of

Disposal of a Segment of a Business.'' The provisions of this statement are eÅective beginning with Ñscal years

starting after December 15, 2001. Management has evaluated the impact of the adoption of this standard and

has determined that this standard will not have a material impact on the Company's Ñnancial position or the

results of operations.

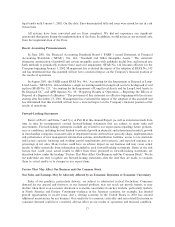

Forward-Looking Statements

Item 1 of Part 1 and Items 7 and 7(a) of Part II of this Annual Report (as well as statements made from

time to time by management) contain forward-looking statements that are subject to many risks and

uncertainties. Forward-looking statements include any related to our expectations regarding future perform-

ance or conditions, including but not limited to potential growth in domestic and international markets, growth

in merchandise categories, increased sales to department stores and footwear specialty shops, implementation

and performance of new management information systems and distribution facilities, access to raw materials

and factory capacity, Ñnancing and working capital requirements and resources, and expected expenses as a

percentage of net sales. Many factors could have an adverse impact on our business and may cause actual

results to diÅer materially from information included in such forward-looking statements. Some of the risk

factors that could cause actual results to diÅer from those projected in forward-looking statements are

described below, under the heading ""Factors That May AÅect Our Business and Our Common Stock''. We do

not undertake any duty to update any forward-looking statements after the date they are made, to conform

them to actual results or to changes in our expectations.

Factors That May AÅect Our Business and Our Common Stock

Our Sales and Earnings May be Adversely AÅected by an Economic Downturn or Economic Uncertainty

Sales of our products, particularly skiwear, are subject to substantial cyclical Öuctuation. Consumer

demand for our apparel and footwear, or our licensed products, may not reach our growth targets, or may

decline, when there is an economic downturn or economic uncertainty in our key markets, particularly markets

in North America and Europe. Continuing weakness in the Japanese economy, for example, has limited

growth opportunities in recent years, and a slowing economy in the United States in 2001 has created

additional uncertainties for our business. Our sensitivity to economic cyclicality and any related Öuctuation in

consumer demand could have a material adverse aÅect on our results of operations and Ñnancial condition.

17