Columbia Sportswear 2001 Annual Report Download - page 34

Download and view the complete annual report

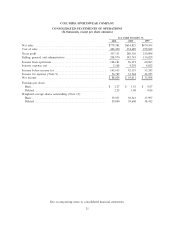

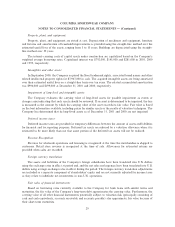

Please find page 34 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 Ì Basis of Presentation and Organization

Nature of the business:

Columbia Sportswear Company is a global leader in the design, manufacture, marketing and distribution

of active outdoor apparel, including outerwear, sportswear, footwear, and related accessories.

Note 2 Ì Summary of SigniÑcant Accounting Policies

Basis of presentation:

The consolidated Ñnancial statements include the accounts of Columbia Sportswear Co. and all wholly-

owned subsidiaries, including GTS Inc., Columbia Sportswear Canada Ltd., Columbia Sportswear Holdings,

Ltd., Columbia Sportswear Japan Ltd., Columbia Sportswear Germany GmbH, Columbia Sportswear France

SNC., Columbia Sportswear Company Ltd., Columbia Sportswear Korea, Sorel Corporation, Columbia

Sportswear S.A.S., Columbia Sportswear International A.G., Columbia Sportswear North America Inc., and

Columbia Sportswear Europe S.A.S., (collectively, the ""Company''). All signiÑcant intercompany balances

and transactions have been eliminated.

The preparation of Ñnancial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that aÅect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Ñnancial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could diÅer from these estimates and assumptions.

Certain reclassiÑcations of amounts reported in the prior period Ñnancial statements have been made to

conform to classiÑcations used in the current period Ñnancial statements.

Dependence on key suppliers:

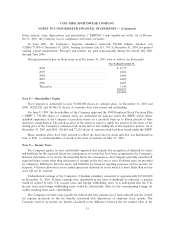

The Company's products are produced by independent manufacturers worldwide. For 2001 the Company

sourced approximately 97% (by dollar volume) of its products outside the United States, principally in the Far

East. Three major factory groups accounted for approximately 17% of the Company's total global production

for 2001 and another company produced substantially all of the zippers used in the Company's products. From

time to time, the Company has experienced diÇculty satisfying its raw material and Ñnished goods

requirements. Although the Company believes that it could identify and qualify additional factories to produce

these materials, the unavailability of some existing manufacturers for supply of these materials could have a

material adverse aÅect on the Company.

Cash and cash equivalents:

Cash and cash equivalents represent cash and short-term, highly liquid investments with maturities of

three months or less at the date of acquisition.

Accounts receivable:

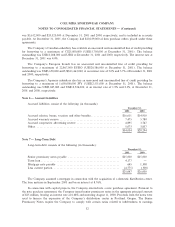

Accounts receivable have been reduced by an allowance for doubtful accounts, which was $8,016,000 and

$5,826,000 in 2001 and 2000, respectively. The net charges to this reserve were $1,341,000, $3,563,000 and

$3,177,000 in 2001, 2000 and 1999, respectively.

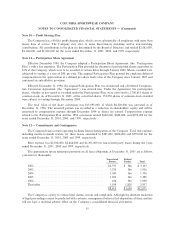

Inventories:

Inventories are carried at the lower of cost or market. Cost is determined using the Ñrst-in, Ñrst-out

method.

28