Columbia Sportswear 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

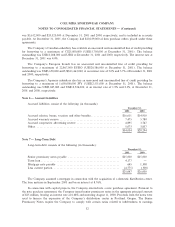

was $5,612,000 and $20,525,000 at December 31, 2001 and 2000, respectively, and is included in accounts

payable. At December 31, 2001, the Company had $20,239,000 of Ñrm purchase orders placed under these

agreements.

The Company's Canadian subsidiary has available an unsecured and uncommitted line of credit providing

for borrowing to a maximum of C$25,000,000 (US$15,705,000 at December 31, 2001). The balance

outstanding was US$10,208,000 and US$0 at December 31, 2001 and 2000, respectively. The interest rate at

December 31, 2001 was 4.0%.

The Company's European branch has an unsecured and uncommitted line of credit providing for

borrowing to a maximum of 22,867,000 EURO (US$20,386,000 at December 31, 2001). The balance

outstanding was US$5,650,000 and US$11,463,000, at an interest rate of 5.0% and 5.7% at December 31, 2001

and 2000, respectively.

The Company's Japanese subsidiary also has an unsecured and uncommitted line of credit providing for

borrowing to a maximum of 1,650,000,000 JPY (US$12,531,000 at December 31, 2001). The balance

outstanding was US$9,047,000 and US$12,524,000, at an interest rate of 1.9% and 2.3%, at December 31,

2001 and 2000, respectively.

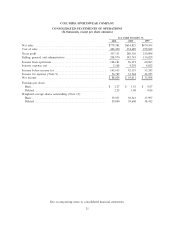

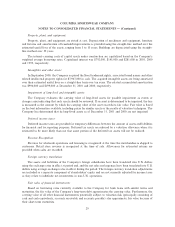

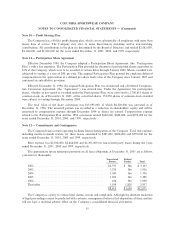

Note 6 Ì Accrued Liabilities

Accrued liabilities consist of the following (in thousands):

December 31,

2001 2000

Accrued salaries, bonus, vacation and other beneÑts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $16,611 $14,910

Accrued warranty reserve ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,475 5,780

Accrued cooperative advertising reserve ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,895 3,747

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,073 3,857

$34,054 $28,294

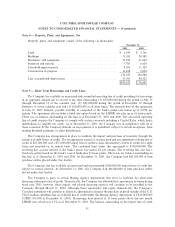

Note 7 Ì Long-Term Debt

Long-term debt consists of the following (in thousands):

December 31,

2001 2000

Senior promissory notes payable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $25,000 $25,000

Term loan ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,177 Ì

Mortgage note payable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 645 1,308

Less current portionÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (4,775) (308)

$25,047 $26,000

The Company assumed a mortgage in connection with the acquisition of a domestic distribution center.

The loan matures in September 2003 and bears interest at 8.76%.

In connection with capital projects, the Company entered into a note purchase agreement. Pursuant to

the note purchase agreement, the Company issued senior promissory notes in the aggregate principal amount

of $25 million, bearing an interest rate of 6.68% and maturing August 11, 2008. Proceeds from the notes were

used to Ñnance the expansion of the Company's distribution center in Portland, Oregon. The Senior

Promissory Notes require the Company to comply with certain ratios related to indebtedness to earnings

32