Columbia Sportswear 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

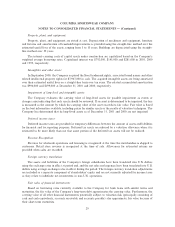

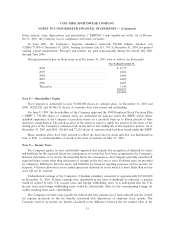

Prior to its initial public oÅering of common stock on April 1, 1998, the Company elected to be treated as

an ""S'' corporation under provision of the Internal Revenue Code of 1986. Accordingly, payment of federal

and most state taxes on income earned in the United States was the responsibility of the shareholders rather

than the Company. In connection with the initial public oÅering the Company terminated its ""S'' corporation

status and entered into a tax indemniÑcation agreement with each of its shareholders, including Gertrude

Boyle, Timothy P. Boyle, Sarah Bany, Don Santorufo and certain trusts. The agreements provide that the

Company will indemnify and hold harmless each of these shareholders for federal, state, local or foreign

income tax liabilities and costs relating thereto, resulting from any adjustment to the Company's income that

is the result of an increase or change in character of the Company's income during the period it was treated as

an ""S'' corporation. The agreements also provide that if there is a determination that the Company was not an

""S'' corporation prior to the OÅerings, the shareholders will pay to the Company certain refunds actually

received by them as a result of the determination.

Note 13 Ì Stock Incentive Plan

The Company's 1997 Stock Incentive Plan (the ""Plan'') provides for issuance of up to 5,400,000 shares

of the Company's Common Stock of which 1,826,823 shares were available for future stock option grants

under the Plan at December 31, 2001. Options granted prior to 2001 generally become exercisable ratably over

a Ñve-year period beginning from the date of grant and expire ten years from the date of grant. Options granted

in 2001 generally become exercisable over a period of four years beginning one year after the date of grant and

expire ten years from the date of the grant.

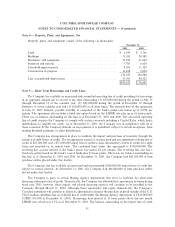

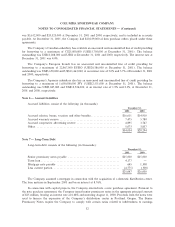

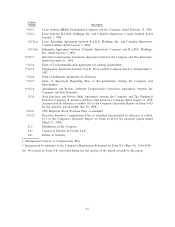

The following table summarizes the stock option activity under the Company's option plan:

Outstanding Exercisable

Weighted Weighted

Average Average

Number of Exercise Number of Exercise

Shares Price Shares Price

Options outstanding at January 1, 1999 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,724,930 $ 9.43 400,553 $ 8.16

Granted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 454,400 8.29

Cancelled ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (104,799) 8.97

Exercised ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (92,267) 6.47

Options outstanding at December 31, 1999 ÏÏÏÏÏÏÏÏÏÏÏÏ 1,982,264 9.33 692,096 $ 8.95

Granted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,028,424 15.03

Cancelled ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (136,806) 10.81

Exercised ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (498,959) 8.50

Options outstanding at December 31, 2000 ÏÏÏÏÏÏÏÏÏÏÏÏ 2,374,923 11.89 712,139 $10.37

Granted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 732,617 31.96

Cancelled ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (178,146) 16.76

Exercised ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (670,191) 10.73

Options outstanding at December 31, 2001 ÏÏÏÏÏÏÏÏÏÏÏÏ 2,259,203 $18.37 618,855 $11.07

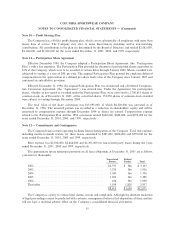

The Company continues to measure compensation cost for the Plan using the method of accounting

prescribed by Accounting Principles Board Opinion No. 25 (""APB 25''). Entities electing to remain with the

accounting in APB 25 must make pro forma disclosures of net income and, if presented, earnings per share, as

if the fair value based method of accounting deÑned in the Statement of Financial Accounting Standards

(""SFAS'') No. 123 ""Accounting for Stock-based Compensation'', had been adopted.

The Company has elected to account for the Plan under APB 25; however, the Company has computed,

for pro forma disclosure purposes, the value of all stock options granted during 2001, 2000 and 1999 using the

36