Brother International 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

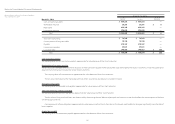

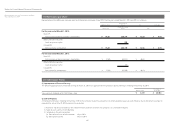

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014 4) Sale price: ¥17,000 million ($165,049 thousand)

5) Other significant matters: Not applicable

(3) Acquisition of Treasury Stock

At the Board of Directors’ meeting held on May 8, 2014, the Company resolved to acquire its own shares to pursue capital efficiency by executing a flexible capital structure

policy, pursuant to Article 156 applied by the reading of terms under Article 165-3 of the Companies Act, and executed it partly based on the resolution.

1) Details of acquisition of the resolution

(a) Type of share: Common stock

(b) Number of shares: Up to 720 million shares (2.71% of currently issued common stock excluding treasury stock)

(c) Period of acquisition: From May 9, 2014 to September 5, 2014

(d) Total purchase price: Up to ¥10,000 million ($97,087 thousand)

(e) Method of acquisition: Shares are acquired on the Securities Exchange.

2) Own share acquisition (executed at the end of May, 2014)

(a) Type of share: Common stock

(b) Number of shares: 1,892,000 shares

(c) Total purchase price: ¥2,908 million ($28,233 thousand)

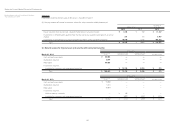

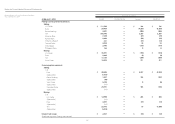

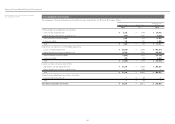

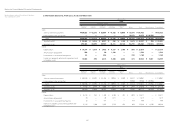

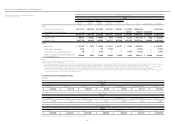

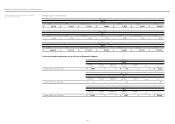

21. Segment Information

Under ASBJ Statement No. 17, “Accounting Standard for Segment Information Disclosures” and ASBJ Guidance No. 20, “Guidance on Accounting Standard for Segment

Information Disclosures,” an entity is required to report financial and descriptive information about its reportable segments. Reportable segments are operating segments

or aggregations of operating segments that meet specified criteria. Operating segments are components of an entity about which separate financial information is avail-

able and such information is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. Generally,

segment information is required to be reported on the same basis as is used internally for evaluating operating segment performance and deciding how to allocate

resources to operating segments.

1. Description of Reportable Segments

The Group’s reportable segments are those for which separate financial information is available and regular evaluation by the Company’s management is being performed

in order to decide how resources are allocated among the Group. The Group consists of five segments, “Printing & Solutions,” “Personal & Home,” “Machinery & Solution,”

“Network & Contents” and “Industrial Part,” in which the Group formulates and implements comprehensive strategies of products and services. “Printing & Solutions” consists

of sales and production of communication printing device such as printers and All-in-Ones, and of sales and production of electronic stationary products. “Personal &

Home” consists of sales and production of home sewing machines. “Machinery & Solution” consists of sales and production of industrial sewing machines and machine

tools. “Network & Contents” consists of sales and production of online karaoke systems, and of content distribution services. “Industrial Part” consists of sales and produc-

tion of reducers and gears.

Effective April 1, 2014, the Group changed its operating segments from four segments, “Printing & Solutions,” “Personal & Home,” “Machinery & Solution” and “Network &

Contents,” to five segments, “Printing & Solutions,” “Personal & Home,” “Machinery & Solution,” “Network & Contents” and “Industrial Part” because the Group reconsidered its

segmentation through the acquisition of additional shares of Nissei Corporation in January 2013.

The segment information for the year ended March 31, 2013, is also disclosed using the new operating segments.

2. Methods of Measurement for the Amounts of Sales, Profit (Loss), Assets and Other Items for Each Reportable Segment

The accounting policies of each reportable segment are consistent with those disclosed in Note 2, “Summary of Significant Accounting Policies.”

Notes to Consolidated Financial Statements