Brother International 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

(18) R&D Costs

R&D costs are charged to income as incurred.

(19) Leases

IIn March 2007, the ASBJ issued ASBJ Statement No. 13, “Accounting Standard for Lease Transactions,” which revised the previous accounting standard for lease transactions.

Under the previous accounting standard, finance leases that were deemed to transfer ownership of the leased property to the lessee were capitalized. However, other

finance leases were permitted to be accounted for as operating lease transactions if certain “as if capitalized” information was disclosed in the note to the lessee’s financial

statements. The revised accounting standard requires that all finance lease transactions be capitalized by recognizing lease assets and lease obligations in the consolidated

balance sheet.

The Group applied the revised accounting standard effective April 1, 2008. In addition, the Group accounted for leases which existed at the transition date and do not

transfer ownership of the leased property to the lessee as operating lease transactions.

All other leases are accounted for as operating leases.

(20) Income Taxes

The provision for current income taxes is computed based on the pretax income included in the consolidated statement of income. The asset and liability approach is used

to recognize deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of assets

and liabilities. Deferred taxes are measured by applying currently enacted income tax rates to the temporary differences.

(21) Foreign Currency Transactions

All short-term and long-term monetary receivables and payables denominated in foreign currencies are translated into Japanese yen at the exchange rates at the consoli-

dated balance sheet date. The foreign exchange gains and losses from translation are recognized in the consolidated statement of income to the extent that they are not

hedged by forward exchange contracts.

(22) Foreign Currency Financial Statements

The balance sheet accounts of the consolidated foreign subsidiaries are translated into Japanese yen at the current exchange rate as of the balance sheet date except for

equity, which is translated at the historical rate. Differences arising from such translation are shown as “Foreign currency translation adjustments” under accumulated other

comprehensive income in a separate component of equity. Revenue and expense accounts of consolidated foreign subsidiaries are translated into Japanese yen at the

average exchange rate.

(23) Derivative and Hedging Activities

The Group uses derivative financial instruments to manage its exposures to fluctuations in foreign exchange and interest rate. Foreign exchange forward contracts, interest

rate swap and currency option contracts are utilized by the Group to reduce foreign currency exchange and interest rate risks. The Group does not enter into derivatives for

trading or speculative purposes.

Derivative financial instruments are classified and accounted for as follows: a) all derivatives are recognized as either assets or liabilities and measured at fair value, and

gains or losses on derivative transactions are recognized in the consolidated statement of income; and b) for derivatives used for hedging purposes, if such derivatives

qualify for hedge accounting because of high correlation and effectiveness between the hedging instruments and the hedged items, gains or losses on derivatives are

deferred until maturity of the hedged transactions.

Foreign currency forward contracts and currency option contracts employed to hedge foreign exchange exposures for export sales are measured at fair value and the

unrealized gains/losses are recognized in income. Foreign currency forward contracts applied for forecasted (or committed) transactions are also measured at fair value but

the unrealized gains/losses are deferred until the underlying transactions are completed.

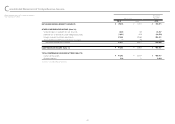

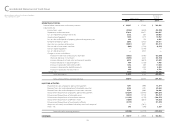

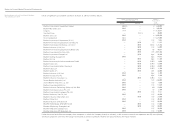

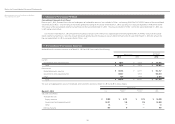

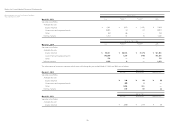

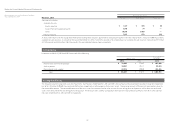

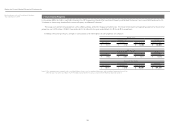

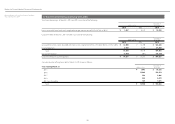

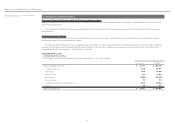

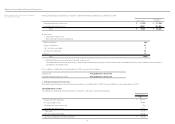

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014

Notes to Consolidated Financial Statements