Brother International 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

(b) The revised accounting standard does not change how to recognize actuarial gains and losses and past service costs in profit or loss. Those amounts are recognized

in profit or loss over a certain period no longer than the expected average remaining service period of the employees. However, actuarial gains and losses and past

service costs that arose in the current period and have not yet been recognized in profit or loss are included in other comprehensive income and actuarial gains and

losses and past service costs that were recognized in other comprehensive income in prior periods and then recognized in profit or loss in the current period shall be

treated as reclassification adjustments (see Note 18).

(c) The revised accounting standard also made certain amendments relating to the method of attributing expected benefit to periods and relating to the discount rate

and expected future salary increases.

This accounting standard and the guidance for (a) and (b) above are effective for the end of annual periods beginning on or after April 1, 2013, and for (c) above are

effective for the beginning of annual periods beginning on or after April 1, 2014, or for the beginning of annual periods beginning on or after April 1, 2015, subject to cer-

tain disclosure in March 2015, both with earlier application being permitted from the beginning of annual periods beginning on or after April 1, 2013. However, no retro-

spective application of this accounting standard to consolidated financial statements in prior periods is required.

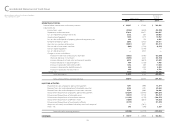

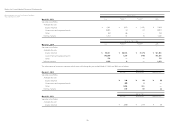

The Group applied the revised accounting standard and guidance for retirement benefits for (a) and (b) above, effective March 31, 2014. As a result, asset for retirement

benefits decreased by ¥5,647 million ($54,825 thousand), liability for retirement benefits increased by ¥2,978 million ($28,913 thousand), accumulated other comprehensive

income decreased by ¥5,979 million ($58,049 thousand) and minority interests increased by ¥16 million ($155 thousand) for the year ended March 31, 2014. In addition, net

asset per share for the year ended March 31, 2014, decreased by ¥22.53 ($0.22).

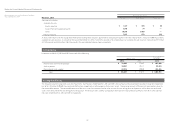

(ii) Retirement Benefits for Directors and Audit & Supervisory Board members

Certain domestic consolidated subsidiaries provide retirement allowances for directors and Audit & Supervisory Board members. Retirement allowances for directors

and Audit & Supervisory Board members are recorded to state the liability which would be paid at the amount if they retired at each consolidated balance sheet date.

The retirement benefits for directors and Audit & Supervisory Board members are paid upon the approval of the shareholders.

(16) Asset Retirement Obligations

In March 2008, the ASBJ issued ASBJ Statement No. 18, “Accounting Standard for Asset Retirement Obligations” and ASBJ Guidance No. 21, “Guidance on Accounting Stan-

dard for Asset Retirement Obligations.” Under this accounting standard, an asset retirement obligation is defined as a legal obligation imposed either by law or contract

that results from the acquisition, construction, development and the normal operation of a tangible fixed asset and is associated with the retirement of such tangible fixed

asset. The asset retirement obligation is recognized as the sum of the discounted cash flows required for the future asset retirement and is recorded in the period in which

the obligation is incurred if a reasonable estimate can be made. If a reasonable estimate of the asset retirement obligation cannot be made in the period the asset retire-

ment obligation is incurred, the liability should be recognized when a reasonable estimate of the asset retirement obligation can be made. Upon initial recognition of a

liability for an asset retirement obligation, an asset retirement cost is capitalized by increasing the carrying amount of the related fixed asset by the amount of the liability.

The asset retirement cost is subsequently allocated to expense through depreciation over the remaining useful life of the asset. Over time, the liability is accreted to its

present value each period. Any subsequent revisions to the timing or the amount of the original estimate of undiscounted cash flows are reflected as an adjustment to the

carrying amount of the liability and the capitalized amount of the related asset retirement cost.

(17) Stock Options

In December 2005, the ASBJ issued ASBJ Statement No. 8, “Accounting Standard for Stock Options” and related guidance. The new standard and guidance are applicable to

stock options newly granted on and after May 1, 2006. This standard requires companies to measure the cost of employee stock options based on the fair value at the date

of grant and recognize compensation expense over the vesting period as consideration for receiving goods or services. The standard also requires companies to account

for stock options granted to non-employees based on the fair value of either the stock option or the goods or services received. In the consolidated balance sheet, the

stock options are presented as stock acquisition rights as a separate component of equity until exercised. The standard covers equity-settled, share-based payment transac-

tions, but does not cover cash-settled, share-based payment transactions. In addition, the standard allows unlisted companies to measure options at their intrinsic value if

they cannot reliably estimate fair value.

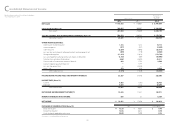

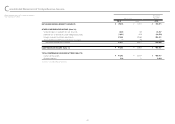

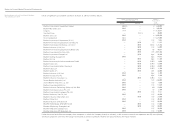

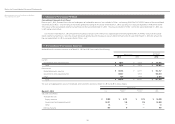

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014

Notes to Consolidated Financial Statements