Brother International 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

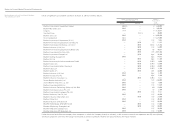

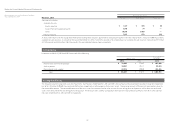

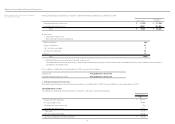

7. Investment Property

In November 2008, the ASBJ issued ASBJ Statement No. 20, “Accounting Standard for Investment Property and Related Disclosures” and issued ASBJ Guidance No. 23,

“Guidance on Accounting Standard for Investment Property and Related Disclosures.”

The Group owns certain rental properties such as office buildings and land in Nagoya and other areas. The net of rental income and operating expenses for those rental

properties was ¥1,093 million ($10,612 thousand) and ¥1,153 million for the years ended March 31, 2014 and 2013, respectively.

In addition, the carrying amounts, changes in such balances and market prices of such properties are as follows:

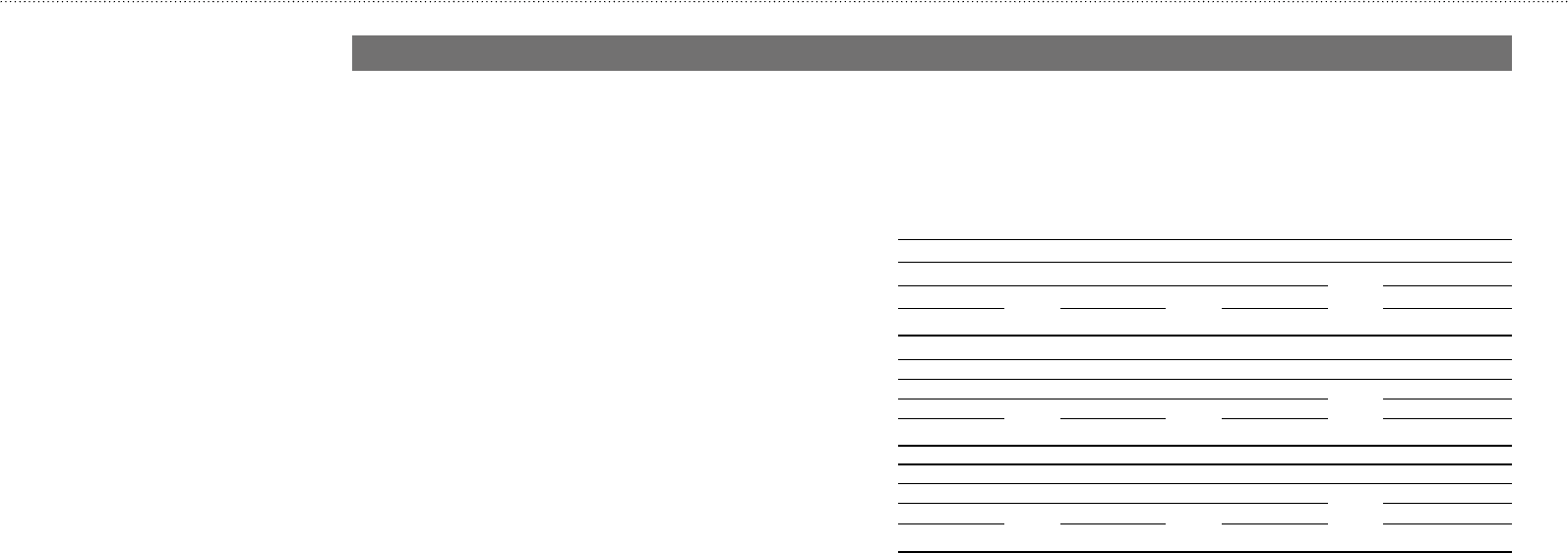

Millions of Yen

Carrying amount Fair value

April 1, 2013 Decrease March 31, 2014 March 31, 2014

¥ 9,371 ¥ (173) ¥ 9,198 ¥ 18,970

Millions of Yen

Carrying amount Fair value

April 1, 2012 Increase March 31, 2013 March 31, 2013

¥ 7,862 ¥ 1,509 ¥ 9,371 ¥ 18,376

Thousands of U.S. Dollars

Carrying amount Fair value

April 1, 2013 Decrease March 31, 2014 March 31, 2014

$ 90,981 $ (1,680) $ 89,301 $ 184,175

Notes: 1) The carrying amount recognized in the consolidated balance sheet is net of accumulated depreciation and accumulated impairment losses, if any.

2) The fair value of properties as of March 31, 2014 is mainly measured by the Group in accordance with its Real-Estate Appraisal Standard.

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014

Notes to Consolidated Financial Statements