Brother International 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

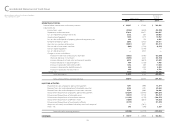

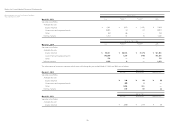

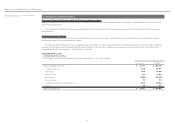

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014 Interest rate swaps which qualify for hedge accounting and meet specific matching criteria are not remeasured at market value but the differential paid or received

under the swap agreements is recognized and included in interest expense.

(24) Per Share Information

Basic net income per share is computed by dividing net income available to common shareholders by the weighted-average number of common shares outstanding for

the period, retroactively adjusted for stock splits.

Diluted net income per share reflects the potential dilution that could occur if securities were exercised. Diluted net income per share of common stock assumes full

exercise of outstanding warrants at the beginning of the year (or at the time of issuance).

Cash dividends per share presented in the accompanying consolidated statement of income are dividends applicable to the respective years including dividends to be

paid after the end of the year.

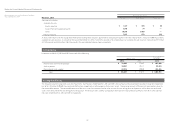

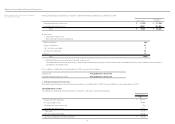

(25) Accounting Changes and Error Corrections

In December 2009, the ASBJ issued ASBJ Statement No. 24, “Accounting Standard for Accounting Changes and Error Corrections” and ASBJ Guidance No. 24, “Guidance on

Accounting Standard for Accounting Changes and Error Corrections.” Accounting treatments under this standard and guidance are as follows: (1) Changes in Accounting

Policies—When a new accounting policy is applied following revision of an accounting standard, the new policy is applied retrospectively unless the revised accounting

standard includes specific transitional provisions, in which case the entity shall comply with the specific transitional provisions. (2) Changes in Presentation—When the

presentation of financial statements is changed, prior-period financial statements are reclassified in accordance with the new presentation. (3) Changes in Accounting

Estimates—A change in an accounting estimate is accounted for in the period of the change if the change affects that period only, and is accounted for prospectively if the

change affects both the period of the change and future periods. (4) Corrections of Prior-Period Errors—When an error in prior-period financial statements is discovered,

those statements are restated.

(26) Consolidated Corporate Tax System

The Group files a tax return under the consolidated corporate-tax system, which allows companies to base tax payments on the combined profits or losses of the parent

company and its wholly owned domestic subsidiaries.

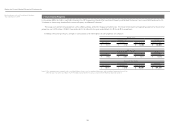

(27) New Accounting Pronouncements

Accounting Standard for Retirement Benefits—On May 17, 2012, the ASBJ issued ASBJ Statement No. 26, “Accounting Standard for Retirement Benefits” and ASBJ

Guidance No. 25, “Guidance on Accounting Standard for Retirement Benefits,” which replaced the Accounting Standard for Retirement Benefits that had been

issued by the Business Accounting Council in 1998 with an effective date of April 1, 2000, and the other related practical guidance, and followed by partial

amendments from time to time through 2009.

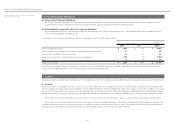

Major changes are as follows:

Amendments relating to the method of attributing expected benefit to periods and relating to the discount rate and expected future salary increases

The revised accounting standard also made certain amendments relating to the method of attributing expected benefit to periods and relating to the discount rate

and expected future salary increases.

This accounting standard and the guidance for the above are effective for the beginning of annual periods beginning on or after April 1, 2014, or for the beginning of

annual periods beginning on or after April 1, 2015, subject to certain disclosure in March 2015, with earlier application being permitted from the beginning of annual peri-

ods beginning on or after April 1, 2013. However, no retrospective application of this accounting standard to consolidated financial statements in prior periods is required.

The Company and domestic subsidiaries expect to apply the revised accounting standard for the above from April 1, 2014, and is in the process of measuring the

effects of applying the revised accounting standard in future applicable periods.

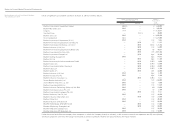

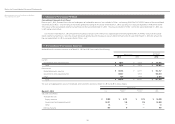

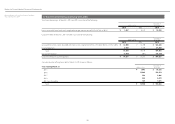

Notes to Consolidated Financial Statements