Brother International 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

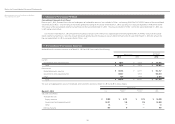

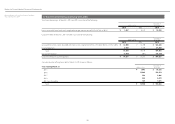

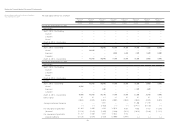

(b) Increases/Decreases and Transfer of Common Stock, Reserve and Surplus

The Companies Act requires that an amount equal to 10% of dividends must be appropriated as a legal reserve (a component of retained earnings) or as additional

paid-in capital (a component of capital surplus) depending on the equity account charged upon the payment of such dividends until the aggregate amount of legal

reserve and additional paid-in capital equals 25% of the common stock. Under the Companies Act, the total amount of additional paid-in capital and legal reserve may

be reversed without limitation. The Companies Act also provides that common stock, legal reserve, additional paid-in capital, other capital surplus and retained earn-

ings can be transferred among the accounts under certain conditions upon resolution of the shareholders.

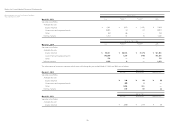

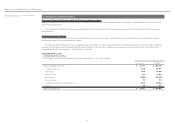

(c) Treasury Stock and Treasury Stock Acquisition Rights

The Companies Act also provides for companies to purchase treasury stock and dispose of such treasury stock by resolution of the Board of Directors. The amount

of treasury stock purchased cannot exceed the amount available for distribution to the shareholders which is determined by specific formula. Under the Compa-

nies Act, stock acquisition rights are presented as a separate component of equity. The Companies Act also provides that companies can purchase both treasury

stock acquisition rights and treasury stock. Such treasury stock acquisition rights are presented as a separate component of equity or deducted directly from stock

acquisition rights.

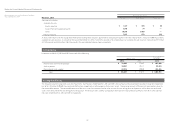

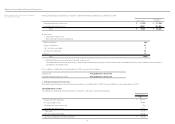

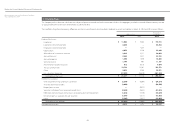

12. Stock Options

The stock options outstanding as of March 31, 2014, were as follows:

Stock Option Persons Granted Number of Options Granted Date of Grant Exercise Price Exercise Period

2007 Stock Option Six directors 46,000 shares March 19, 2007 ¥ 1

($0.01)

30 years starting on the day following

the stock option grant date

2008 Stock Option Six directors 65,100 shares March 24, 2008 ¥ 1

($0.01) Same as above

2009 Stock Option Five directors 114,500 shares March 23, 2009 ¥ 1

($0.01) Same as above

2010 Stock Option Four directors

14 executive o cers

51,900 shares

49,600 shares March 23, 2010 ¥ 1

($0.01) Same as above

2011 Stock Option Four directors

13 executive o cers

43,200 shares

40,300 shares March 23, 2011 ¥ 1

($0.01) Same as above

2012 Stock Option Three directors

16 executive o cers

44,600 shares

61,800 shares March 23, 2012 ¥ 1

($0.01) Same as above

2013 Stock Option Two directors

16 executive o cers

36,600 shares

69,500 shares March 21, 2013 ¥ 1

($0.01) Same as above

2014 Stock Option Three directors

16 executive o cers

30,800 shares

49,600 shares March 27, 2014 ¥ 1

($0.01) Same as above

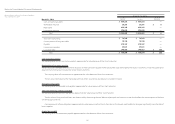

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014

Notes to Consolidated Financial Statements