Brother International 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

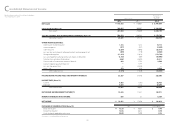

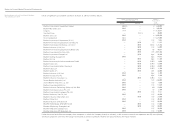

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2014

Millions of Yen

Thousands of

U.S. Dollars

(Note 1)

2014 2013 2014

OPERATING ACTIVITIES:

Income before income taxes and minority interests ¥33,527 ¥ 27,946 $325,505

Adjustments for:

Income taxes - paid (9,755) (8,816) (94,709)

Depreciation and amortization 27,614 24,477 268,097

Loss on impairment of long-lived assets 2,122 269 20,602

Amortization of goodwill 1,538 1,419 14,932

Loss on sales and disposals of property, plant and equipment, net 459 170 4,456

Foreign exchange loss (gain) 2,092 (2,421) 20,311

(Gain) loss on valuation of derivatives (4,461) 4,625 (43,311)

Gain on sales of investment securities (465) (1,724) (4,515)

Gain on negative goodwill —(7,194) —

Loss on step acquisitions —3,843 —

Changes in assets and liabilities:

Increase in trade notes and accounts receivable (5,423) (4,501) (52,650)

(Increase) decrease in inventories (5,994) 2,333 (58,194)

Increase (decrease) in trade notes and accounts payable 6,973 (6,673) 67,699

Increase (decrease) in accrued expenses 808 (1,729) 7,845

Increase in liability for retirement benefits 1,752 430 17,010

Increase in allowance for doubtful accounts 884 1,443 8,583

Increase in liability for warranty reserve 899 178 8,728

Other - net 2,449 (1,341) 23,776

Total adjustments 21,492 4,788 208,660

Net cash provided by operating activities 55,019 32,734 534,165

INVESTING ACTIVITIES:

Proceeds from sales of property, plant and equipment 1,361 1,080 13,214

Proceeds from sales and redemption of marketable securities 5,103 1,301 49,544

Proceeds from sales and redemption of investment securities 2,761 2,660 26,806

Disbursement for purchases of property, plant and equipment (27,634) (24,942) (268,291)

Disbursement for purchases of intangible assets (6,635) (5,723) (64,417)

Disbursement for purchases of investment securities (11,152) (2,170) (108,272)

Disbursement for purchases of affiliates' shares (1,059) (6,617) (10,282)

Disbursement for purchases of investment in affiliates (2,188) —(21,243)

Acquisition of a newly consolidated subsidiary, net of cash acquired —(7,011) —

Other - net 343 (350) 3,329

Net cash used in investing activities (39,100) (41,772) (379,612)

FORWARD ¥15,919 ¥(9,038) $154,553

onsolidated Statement of Cash Flows

C