Westjet 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

8

We are disappointed with our financial performance in 2004. This

was an extremely challenging year for our airline and for our

industry as a whole as we had to deal with record high fuel prices,

rising operating costs and fierce competition. Despite these

challenges, we were able to grow our airline by 30%, maintain a

load factor of 70% and reduce our unit costs in many areas as we

adapted to these new market conditions.

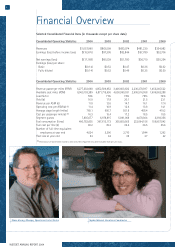

Total revenue for the year was $1.06 billion compared with

$863.6 million in 2003, while expenses were up to $1.07 billion

from $749.1 million in 2003. Our loss from operations in 2004

totalled $9.9 million compared with earnings from operations of

$114.5 million in 2003. This loss included a $47.6 million write-

down in the fourth quarter on the early replacement of our fleet

of 737-200 aircraft due to their shortened revenue life.

The cumulative effect of the accelerated replacement

program and the weak operating environment led us to

a net loss for 2004 of $17.2 million, down from net

earnings of $60.5 million in 2003. Excluding the write-

down, we estimate we would have achieved net earnings

in 2004 of $18.4 million.

We reported a diluted loss per share for the year, including

the write-down, of 14 cents, down from diluted earnings

per share of 52 cents for full-year 2003. Our costs in 2004

were higher than in 2003, with cost per available seat mile

rising to 11.4 cents, excluding the write-down, from 10.9

cents in 2003.

President’s Message

to Shareholders