Westjet 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

38

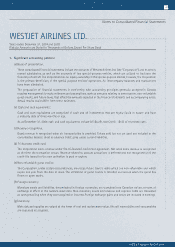

the period the credit is issued. The utilization of guest

credits is recorded as revenue when the guest has flown

or upon expiry.

The Company uses the liability method of accounting

for future income taxes. This methodology requires a

significant amount of judgment regarding assumptions

and the use of estimates, which can create significant

variances between actual results and estimates

including the scheduling of our effective tax rate and

the potential realization of future tax assets and

liabilities in the future.

The Accounting Standards Board (“AcSB”) is proposing

to issue three new handbook sections, FINANCIAL

INSTRUMENTS - RECOGNITION AND MEASUREMENT,

Section 3855, HEDGES, Section 3865, and

COMPREHENSIVE INCOME, Section 1530, specifying

when a financial instrument or non-financial derivative

is to be recognized on the balance sheet. These sections

will require a financial instrument or non-financial

derivative to be measured at fair value, amortized cost

or cost; establish how gains and losses are to be

recognized and presented, including introducing

comprehensive income; specify how hedge accounting

should be applied; establish new disclosures about an

entity's accounting for designated hedging relationships

and the methods and assumptions applied in

determining fair values.

The AcSB expects to issue the Sections in early 2005.

The mandatory effective date for Sections 1530,

Comprehensive Income, 3855, Financial Instruments -

Recognition and Measurement, and 3865, Hedges,

would be for interim and annual financial statements

relating to fiscal years beginning on or after October

1, 2006. Earlier adoption will be permitted only as of

the beginning of a fiscal year ending on or after

December 31, 2004.

The AcSB has issued an Exposure Draft proposing

amendments to Section 3500, Earnings per Share. The

AcSB expects to issue a final standard in the first quarter

of 2005. Proposed changes would amend the

computational guidance in Section 3500 for calculating

the number of incremental shares included in diluted

earnings per share when applying the treasury stock

method. When applying the treasury stock method for

year-to-date diluted earnings per share, current guidance

requires that the number of incremental shares included

in the denominator be determined by computing a year-

to-date weighted average of the number of incremental

shares included in each interim diluted earnings per share

calculation. Under the proposed amendments, the

number of incremental shares included in year-to-date

diluted earnings per share would be computed using the

average market price of common shares for the year-

to-date period. Proposed amendments to Section 3500

would also require that, for the purposes of computing

diluted earnings per share, an entity should assume that

a contract that could be settled in cash or common

shares would be settled in common shares, if share

settlement is more dilutive. Proposed amendments would

eliminate provisions that allow an entity to rebut the

assumption that contracts with the option of settling in

either cash or common shares, at the issuer's option, will

be settled in common shares.

The AcSB plans to issue final standards in the first

quarter of 2005. The AcSB will endeavour to make the

Larry Richards, Engine Shop Technician