Westjet 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

52

Notes to Consolidated Financial Statements

WESTJET AIRLINES LTD.

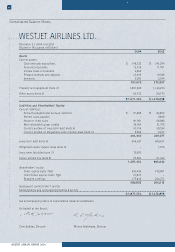

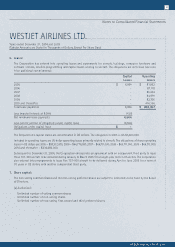

4. Long-term debt (continued):

The net book value of the property and equipment pledged as collateral for the Corporation’s secured borrowings was

$1,288,497,000 as at December 31, 2004 (2003 – $810,767,000).

Held within the special-purpose entities, as described in note 1, are liabilities of $1,178,239,000 and corresponding assets

of $1,178,342,000, which are included in the consolidated financial statements.

Future scheduled repayments of long-term debt are as follows:

2005 $ 97,305

2006 92,163

2007 92,332

2008 97,625

2009 91,027

2010 and thereafter 532,484

$ 1,002,936

The Corporation is charged a commitment fee of 0.125% per annum on the unutilized and uncancelled balance of the

Export-Import Bank (“Ex-Im Bank”) loan guarantees payable at specified dates and upon delivery of an aircraft, and is

charged a 3% exposure fee on the financed portion of the aircraft price, payable upon delivery of an aircraft.

In 2004, the Corporation cancelled the remaining balance of the unutilized portion of the Ex-Im Bank final commitment

totalling US $49.6 million, related to the first 26 purchased Boeing 737-700 aircraft delivered by the end of 2004.

Ex-Im Bank has provided a preliminary commitment of US $415 million for 13 aircraft to be delivered in 2005 and 2006.

The Corporation has available a facility with a Canadian chartered bank for $8,000,000 (2003 – $8,000,000) for letters

of guarantee. At December 31, 2004, letters of guarantee totaling $7,977,000 (2003 – $5,921,000) have been issued under

these facilities. The credit facilities are secured by a general security agreement and an assignment of insurance proceeds.

Cash interest paid during the year was $42,346,000 (2003 – $21,938,000).

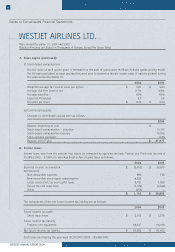

5. Long-term liabilities:

The Corporation recorded $10,000,000 (2003 – $Nil) of unearned revenue related to the tri-branded credit card for future

net retail sales. The unearned revenue will be drawn down commencing in May 2005 under this five-year agreement.

Years ended December 31, 2004 and 2003

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)