Westjet 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

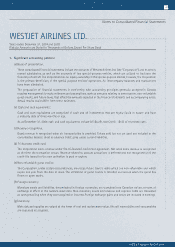

15, 2004 against the Corporation, an officer and a

former officer (the “defendants”). The principal

allegations are that the defendants conspired together

to unlawfully obtain Jetsgo's proprietary information

and to use this proprietary information to harm Jetsgo

and benefit WestJet. The Plaintiff is seeking damages,

in an amount to be determined plus $50 million, but

the Plaintiff has provided no details or evidence to

substantiate its claim.

Based on the results to date of (i) an internal investigation,

(ii) advice from independent industry experts, and (iii)

cross-examinations of witnesses in the Air Canada

proceedings, management believes the amounts claimed

are substantially without merit. The amount of loss, if

any, to the Corporation as a result of these two claims

cannot be reasonably estimated. The defence and

investigation of these claims are continuing.

Accounting Policies and Critical

Accounting Estimates

Critical accounting estimates are defined as those that

require the Company to make assumptions about

matters that are highly uncertain at the time the

accounting estimates are made, and could potentially

result in materially different results under different

assumptions and conditions. For further discussion of

these and other accounting policies we follow, see Note

1 to our consolidated financial statements.

We make estimates about the expected useful lives,

projected residual values and the potential for

impairment of our property and equipment. In

estimating the lives and expected residual values of

our fleet of aircraft, WestJet has relied upon annual

independent appraisals, recommendations from

Boeing, and actual experience with the same aircraft

types. Revisions to the estimates for our fleet can be

caused by changes in the utilization of the aircraft or

changing market prices of used aircraft of the same

type. We evaluate our estimates and potential

impairment on all property and equipment annually

and when events and circumstances indicate that the

assets may be impaired

.

We make estimates in accounting for our liability related

to certain types of non-refundable guest credits. We

may issue future travel credits related to guest

compensation for flight delays, missing baggage and

other inconveniences as a gesture of good faith. These

types of credits are non-refundable and expire one year

from the date of issue. We record a liability based on

the estimated incremental cost of a one-way flight in

Shane Anderson, CARE Coordinator

Contractual Obligations

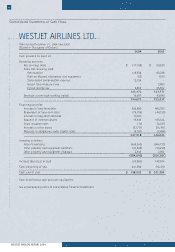

(millions)

Total 2005 2006 2007 2008 2009 Thereafter

Long-term debt repayments $ 1,003 $ 97 $ 92 $ 92 $ 98 $ 91 $ 533

Capital lease

obligations (1)(2) 77–––––

Operating leases (3) 838 82 87 85 85 83 416

Purchase obligations (4) 491 302189––––

Total contractual obligations $ 2,339 $ 488 $ 368 $ 177 $ 183 $ 174 $ 949

(1) The Company’s capital leases are denominated in US dollars. The obligations in 2005 is US $5,800,000.

(2) Includes imputed interest at 8.09% totalling $420,000.

(3) Included in operating leases are US dollar operating leases primarily related to aircraft. The obligations of these operating leases in US dollars are 2005 – $58,312,000;

2006 – $66,776,000; 2007 – $66,711,000; 2008 – $66,711,000; 2009 – $66,711,000; 2010 and thereafter – $330,083,000.

(4) Relates to purchases of aircraft, live satellite television systems, winglets, fixed-base trainer and Next-Generation flight simulator.

37