Westjet 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

Notes to Consolidated Financial Statements

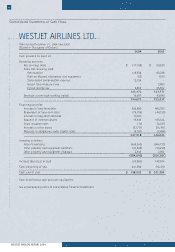

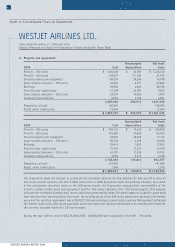

WESTJET AIRLINES LTD.

Years ended December 31, 2004 and 2003

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

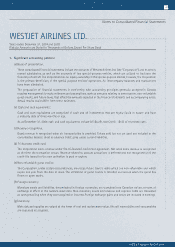

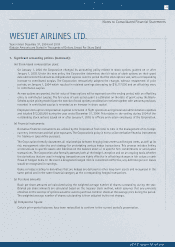

1. Significant accounting policies:

(a) Basis of presentation:

These consolidated financial statements include the accounts of WestJet Airlines Ltd. (the “Corporation”) and its wholly

owned subsidiaries, as well as the accounts of two special-purpose entities, which are utilized to facilitate the

financing of aircraft. The Corporation has no equity ownership in the special-purpose entities; however, the Corporation

is the primary beneficiary of the special-purpose entities’ operations. All intercompany balances and transactions

have been eliminated.

The preparation of financial statements in conformity with accounting principles generally accepted in Canada

requires management to make estimates and assumptions, such as amounts relating to amortization, non-refundable

guest credits, and future taxes, that affect the amounts reported in the financial statements and accompanying notes.

Actual results could differ from these estimates.

(b) Cash and cash equivalents:

Cash and cash equivalents are comprised of cash and all investments that are highly liquid in nature and have

a maturity date of three months or less.

As at December 31, 2004 cash and cash equivalents include US $4,251,000 (2003 – $nil) of restricted cash.

(c) Revenue recognition:

Guest revenue is recognized when air transportation is provided. Tickets sold but not yet used are included in the

consolidated balance sheet as advance ticket sales under current liabilities.

(d) Tri-branded credit card:

The Corporation earns revenue under the tri-branded credit card agreement. Net retail sales revenue is recognized

at the time the transaction occurs. Revenue related to account activations is deferred and not recognized until the

credit file issued for the new activation is used or expires.

(e) Non-refundable guest credits:

The Corporation, under certain circumstances, may issue future travel credits which are non-refundable and which

expire one year from the date of issue. The utilization of guest credits is recorded as revenue when the guest has

flown or upon expiry.

(f) Foreign currency:

Monetary assets and liabilities, denominated in foreign currencies, are translated into Canadian dollars at rates of

exchange in effect at the balance sheet date. Non-monetary assets and revenue and expense items are translated

at rates prevailing when they were acquired or incurred. Foreign exchange gains and losses are included in earnings.

(g) Inventory:

Materials and supplies are valued at the lower of cost and replacement value. Aircraft expendables and consumables

are expensed as acquired.

47