Westjet 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

35

during December, and this was further exaggerated by

this year's relatively shorter Christmas holiday period.

Total operating revenue increased by 18.9% to $273.7

million in the last three months of 2004 compared to

$230.2 million in same period in 2003. Our fourth

quarter yield dropped by approximately 5.8% over the

same period last year.

Excluding the $47.6 million impairment loss included in

amortization expense, total CASM increased by 9.4%

for the three months ended December 31, 2004 to 11.7

cents compared to 10.7 cents in the fourth quarter of

the previous year. Our average stage length increased

from 684.7 miles in the last quarter of 2003 to 788.3

miles in the same period of 2004. We estimate the unit

cost benefit derived from this increased stage length to

be approximately 7%; however, persistent cost pressures

in the fourth quarter largely attributable to increases in

jet fuel prices and rising airport operation costs negated

the cost advantages we realized from increased long-

haul flying.

World fuel prices increased dramatically in the last three

months of the year with WTI US dollars per barrel of

crude increasing 54.9% and 10.2% over the fourth

quarter of 2003 and the third quarter of 2004

respectively. This significantly impacted our fuel cost

per litre which increased 47.4% from 37 cents per litre

in the fourth quarter of 2003 to 56 cents per litre in

the same period in 2004. The dramatic fuel price

escalation in the fourth quarter resulted in a 42.0%

increase in cost per ASM when compared to the fourth

quarter in 2003.

In the three months ended December 31, 2004, our

airport operations expanded to include seven

destinations in the United States (service to our eighth

United States destination, Palm Springs, began on

January 7, 2005). Additionally, our people opened

facilities for our guests in 15 additional charter cities

not previously served in the fourth quarter last year.

For the quarter, airport operations experienced a 9.0%

increase in cost per ASM compared to the same period

in 2003. Our cost per departure, which excludes any

impact from stage length dilution, increased by 23.2%

during the three-month period compared to the fourth

quarter of last year.

Airport operations witnessed increased costs in four key

areas. The most significant impact to operations was the

roughly 9.0% increase in airport rates and fees over the

same period in 2003. Additionally, we continued to grow

our operations in Toronto, Canada's most expensive

airport. For the three months ended December 31, 2004,

Toronto saw departure growth of almost 242%

compared to the same period in 2003. Furthermore, we

continued the growth of our Next-Generation 737-700

fleet, which increased the proportion of total flights

made by 700-series aircraft. As fees are generally linked

to the size of an aircraft, cost per departure increased

with the growth in percentage of total flights made by

737-700s. Finally, the expansion into the United States

that commenced in September 2004 resulted in

additional costs from our Canadian airports, as airports

charge elevated rates for international operations.

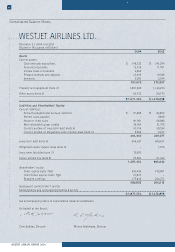

Financial Condition

Liquidity and Capital Resources

We ended 2004 with a solid cash position of $148.5 million

compared to $241.4 million in 2003. We completed the

year with a working capital ratio of 0.6 compared to 1.2

at the end of the previous year. The decrease in our cash

position and working capital ratio was primarily due to

the decrease in operating cash flow as a result of the weak

yield environment and high fuel prices and airport costs.

In addition, as we take on additional debt from purchases

of Next-Generation aircraft, our current liabilities will

increase as a result of an increase in obligations due within

the upcoming year.

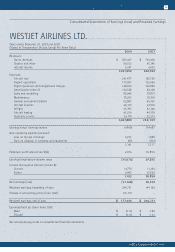

Operating cash, derived primarily from providing air

transportation to our guests through our operating

activities, continues to generate stable cash flow. Operating

cash outflows are primarily related to the recurring

expenses of operating the airline. During the 12-months

ended December 31, 2004, we produced $144.1 million

cash from operations compared to $192.4 million in the

previous year. For 2004, the decrease in operating cash

flows primarily was a result of lower fare revenue realized

on ticket sales.

Joanne Leskow, Team Leader, CARE