Westjet 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTJET ANNUAL REPORT 2004

Notes to Consolidated Financial Statements

WESTJET AIRLINES LTD.

Years ended December 31, 2004 and 2003

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

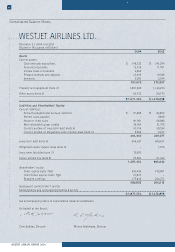

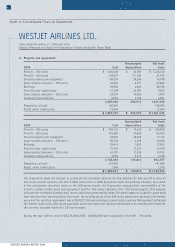

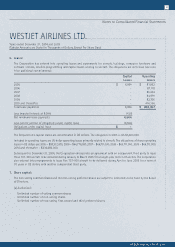

3. Other assets:

Included in other assets are financing fees of $34,870,000 (2003 – $22,588,000), net of accumulated amortization of

$4,268,000 (2003 – $1,515,000) related to the facility for the purchase of 26 Boeing Next-Generation aircraft, unamortized

hedge settlements of $16,238,000 (2003 – $17,630,000) related to the 10 leased Boeing Next-Generation aircraft,

security deposits on aircraft and other leaseholds of $24,563,000 (2003 – $14,782,000), NAV Canada security deposit

of $4,500,000 (2003 – $4,500,000) and other amounts totalling $562,000 (2003 – $275,000).

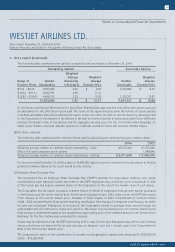

4. Long-term debt:

2004 2003

$1,053,530,000 in 26 individual term loans, amortized on a straight-line basis over

a 12-year term, repayable in quarterly principle instalments ranging from $768,000

to $955,000, guaranteed by the Ex-Im Bank, secured by 26 700-series aircraft, and

maturing in 2014 through 2016. Twenty-five of these facilities include fixed rate

weighted average interest at 5.46%. The remaining facility totaling $40,372,000

bears a floating interest rate at the Canadian LIBOR rate plus 0.08% (effective interest

rate of 2.84% as at December 31, 2004) until the first scheduled repayment date in

February 2005, after such time the interest rate on the loan will be fixed at a rate

of 5.92% for the remaining term of the loan $ 954,674 $ 600,047

$26,000,000 in two term loans, repayable in monthly instalments ranging from

$106,000 to $156,000 including floating interest at the bank’s prime rate plus

0.88% with an effective interest rate of 5.13% as at December 31, 2004, with

varying maturities ranging between July 2008 and July 2013, secured by two

Next-Generation flight simulators and cross-collateralized by one 200-series aircraft 21,684 23,751

$12,000,000 term loan, repayable in monthly instalments of $108,000 including

interest at 9.03%, maturing April 2011, secured by the Calgary hangar facility 11,075 11,360

$22,073,000 in six individual term loans, repayable in monthly instalments

ranging from $25,000 to $87,000 including fixed rate weighted average interest

at 8.43% all maturing in October 2005, secured by three 200-series aircraft 5,301 9,390

$4,550,000 term loan repayable in monthly instalments of $50,000 including floating

interest at the bank’s prime rate plus 0.50%, with an effective interest rate of 4.75%

as at December 31, 2004, maturing April 2013, secured by the Calgary hangar facility 3,899 4,317

$6,939,000 in 11 individual term loans, amortized on a straight-line basis over a

five-year term, repayable in monthly principal instalments ranging from $29,000

to $33,000 including floating interest at the Canadian LIBOR rate plus 0.08%, with

a weighted average effective interest rate of 2.78%, maturing in 2009, guaranteed

by the Ex-Im Bank and secured by certain 700-series aircraft 6,303 –

1,002,936 648,865

Less current portion 97,305 59,334

$ 905,631 $ 589,531

51