Westjet 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

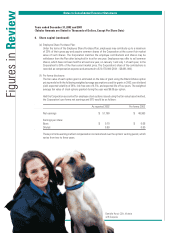

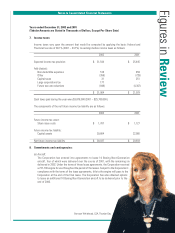

Figures in Review

Notes to Consolidated Financial Statements

Years ended December 31, 2002 and 2001

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

9. Risk management:

(a) Fuel risk management:

The Corporation has mitigated its exposure to jet fuel price volatility through the use of long-term

fixed price contracts and contracts with a fixed ceiling price which it has entered into with a fuel

supplier. Any premiums paid to enter into these long-term fuel arrangements are recorded as other

long-term assets and amortized to fuel expense over the term of the contracts. As at December 31,

2002, the Corporation had a fixed ceiling price fuel contract that is in effect through to June 2003,

at an indicative price of US $18.60 per barrel of crude oil. In 2002, this contract represented 32%

(2001 – 42%) of the Corporation’s fuel requirements.

(b) Foreign currency exchange risk:

The Corporation is exposed to foreign currency fluctuations as certain ongoing expenses are referenced

to US dollar denominated prices. The Corporation periodically uses financial instruments, including

forward exchange contracts and options, to manage its exposure. At December 31, 2002 the Corporation

did not have any foreign currency financial instruments outstanding.

(c) Interest rate risk:

The Corporation has managed its exposure to interest rate fluctuations on debt financing for the next

11 Boeing Next-Generation aircraft scheduled to be delivered over the course of 2003. The Corporation

has managed this exposure by entering into Forward Starting Interest Rate Agreements at rates

between 5.36% and 5.85%.

The Corporation has entered into fixed rate debt instruments in order to manage its interest-rate exposure

on existing debt agreements. These agreements are described in note 4.

(d) Credit risk:

The Corporation does not believe it is subject to any significant concentration of credit risk. Most of

the Corporation’s receivables result from tickets sold to individual guests through the use of major credit

cards and travel agents. These receivables are short-term, generally being settled shortly after the

sale. The Corporation manages the credit exposure related to financial instruments by selecting counter

parties based on credit ratings, limiting its exposure to any single counter party and monitoring the

market position of the program and its relative market position with each counter party.

(e) Fair value of financial instruments:

The carrying amounts of financial instruments included in the balance sheet, other than long-term

debt, approximate their fair value due to their short term to maturity.

At December 31, 2002, the fair value of

long-term debt was approximately $236

million. The fair value of long-term debt is

determined by discounting the future

contractual cash flows under current

financing arrangements at discount rates

which represent borrowing rates presently

available to the Corporation for loans with

similar terms and maturity.

2002 WestJet Annual Report 51

Michelle Francis, Trainer