Westjet 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 2002 WestJet Annual Report

Financial Condition

Dollars &

Sense

WestJet started 2002 with $58.9

million in cash, and finished

with an ample $100.4 million.

At each of the three quarter ends dur-

ing the year, we had in excess of $150

million in cash. The first quarter cash

reserves were boosted by an $82.5 mil-

lion equity financing and a huge surge

in advance bookings by our guests to

beat the April first security tax imple-

mentation date. This resulted in a $32.1

million increase in cash in three months

from the typically low level of advance

bookings at December 31 when

Canadians are not yet thinking about

summer domestic travel plans.

The second quarter saw cash grow

again, as can be expected during this

period. Advance bookings grew by

$18.3 million from April to June due

to our growth and as people planned

their summer travel. Canadians tend

to book their December holiday sea-

son travel plans well in advance, and

understand that booking early will

provide improved choice and better

airfares. At September 30, the end of

our third quarter, cash on hand from

advance bookings remained high at

$59.3 million.

In the fourth quarter, as can be

expected, cash on hand from advance

bookings reduced to its lowest point at

the end of the year to $44.2 million at

December 31, 2002. This was normal

and caused by a seasonal 26% quarter-

ly decline, or $15.1 million, reduction in

advance bookings. Capital cash expen-

ditures in excess of debt activity of $39

million and our $11 million profit share

pay-out to employees in November

further led to this expected reduction

in cash from the year’s high of $165.5

million at September 30, 2002.

WestJet’s working capital ratio was

down slightly in 2002 to 0.8 at Dec-

ember 31 compared with 0.9 at the end

of 2001. This was primarily due to

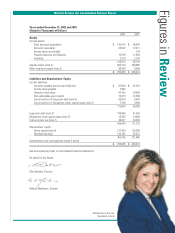

Karen Daley, Purchaser, Corporate

Supplies and Services, has found exactly

what she’s looking for with WestJet.

Financial Condition