Westjet 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Figures in Review

Notes to Consolidated Financial Statements

42 2002 WestJet Annual Report

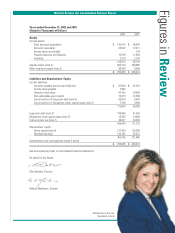

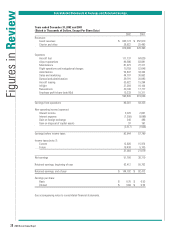

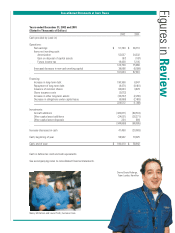

Years ended December 31, 2002 and 2001

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

1. Significant accounting policies (continued):

(l) Stock-based compensation plans:

Currently all outstanding stock options of the Corporation have been granted to employees of the Corporation

and no compensation cost has been recorded for these awards. Consideration paid by employees on

the exercise of stock options is recorded as share capital. The Corporation has disclosed the pro forma

effect of accounting for these rewards under the fair value based method (see note 6(f)).

(m) Financial instruments:

The Corporation utilizes derivatives and other financial instruments to manage its exposure to changes

in foreign currency exchange rates, interest rates and jet fuel price volatility. Gains or losses relating

to derivatives that are hedges are deferred and recognized in the same period and in the same

financial category as the corresponding hedged transactions.

(n) Per share amounts:

Basic per share amounts are calculated using the weighted average number of shares outstanding

during the year. Diluted per share amounts are calculated based on the treasury stock method, which

assumes that any proceeds obtained on exercise of options would be used to purchase common shares

at the average price during the period. The weighted average number of shares outstanding is then

adjusted by the net change. In computing diluted net earnings per share, 1,339,511 (2001 - 1,319,183)

shares were added to the weighted average number of common shares outstanding of 73,942,259

(2001 – 68,889,768) for the year ended December 31, 2002 in determining the dilutive effect of

employee stock options.

(o) Comparative figures:

Certain prior period balances have been reclassified to conform with current period’s presentation

and to comply with a change in accounting policy (see note 1(e)).

Rick Walker-Dade and

Laurel Moore, Flight Attendants