Westjet 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 WestJet Annual Report 33

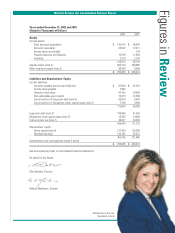

2002’s capital expenditures totaling

$73.6 million with cash outlay in excess

of financing. Capital outlays of $344.9

million during 2002 were primarily

used for aircraft acquired in 2002,

which represented $212.4 million of

this total investment. The proceeds of

the Ex-Im Bank debt financing amount-

ed to $190.4 million.

During 2002, WestJet paid Boeing

further cash deposits on 2003 through

2006 deliveries totaling $108.5 million.

Other cash capital expenditures includ-

ed deposits on our second 737-700

simulator of $9.2 million, computer

hardware and software purchases of

$7.5 million, the Calgary and Hamilton

hangar construction of $9.2 million, a

$2.1 million fixed-base trainer that will

be installed upon completion of the

Calgary hangar expansion, spare

parts and tooling to support the

737-700 fleet of $5.8 million,

and airport and ground han-

dling equipment of $7.8

million. The unencumbered

capital assets such as hangar

facilities, our 737-700 simula-

tor and spare parts, and ground

handling equipment are avail-

able to pledge as security should

WestJet decide to finance a

portion of them with long-term

debt in order to increase our

current ratio.

WestJet’s total off-balance

sheet assets and liabilities relat-

ing to 10 737-700 and two 737-200

operating leased aircraft amounts to

$393 million at December 31, 2002 as

compared with $179 million at

December 31, 2001. Our total debt-to-

equity ratio, including the operating

leases, was 1.1 to 1 at December 31,

2001. The $82.5 million share issue in

2002, together with retained earnings of

$144.2 million, put WestJet’s total debt-

to-equity ratio on December 31, 2002

at 1.8 to 1.

This debt-to-equity ratio accom-

plishment is especially pleasing con-

sidering the addition to our fleet of six

737-700 operating leases and four 737-

700 aircraft with 85% Ex-Im Bank debt

financing. Our philosophy is to main-

tain a strong balance sheet with a

debt-to-equity range of approximately

2.0 or 3.0 to 1. These are enviable

measures in this industry, and they still

leave WestJet with ample room to con-

tinue our program of new aircraft

acquisitions.

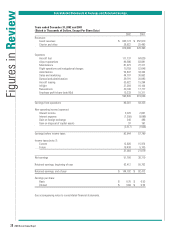

EX-IM BANK FINANCING

The fourth quarter of 2002 marked an

important milestone for our Corpor-

ation as we completed financing

arrangements, supported by loan

guarantees from the Ex-Im Bank, for

US $477.8 million that is to be used

for the purchase of 15 Boeing

Next-Generation 737-700 aircraft.

Additionally, WestJet has received a

preliminary commitment from the Ex-

Im Bank for loan guarantees to

support the acquisition of the remain-

ing 15 Boeing 737-700 aircraft we

have committed to purchasing prior

to year-end 2006. Securing this

financing and additional Ex-Im Bank

guarantee has provided WestJet with

the ability to expand our fleet of Next-

Generation aircraft while

adhering to our low-cost

philosophies and maintaining

our strong financial position.

This facility will be drawn

in Canadian dollars in separate

instalments for each new air-

craft. Each loan will be

amortized on a straight-line

basis over the 12-year term in

equal quarterly principal

instalments, with interest cal-

culated on the outstanding

principal balance. During the

fourth quarter of 2002,

WestJet accepted delivery of

the first four of these aircraft

with the remaining scheduled to be

delivered prior to year-end 2003.

Having the ability to draw these

funds in Canadian dollars significantly

reduces the Corporation’s exposure to

foreign currency fluctuations as the vast

majority of our revenue is in Canadian

dollars. Prior to each delivery, howev-

er, WestJet is exposed to fluctuations in

the Canadian/United States exchange

rate as the aircraft are paid for at the

date of delivery in US funds. We feel

this exposure is mitigated as aircraft

deliveries are spread out over time, and

therefore WestJet will effectively

achieve an average rate of exchange.

...WestJet’s total

debt-to-equity ratio on

December 31, 2002

was 1.8 to 1. Anne Lindsay, Flight Attendant,

lends a helping hand in BeanLand.

Emily Little, SSA, flashes a big smile.