Westjet 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

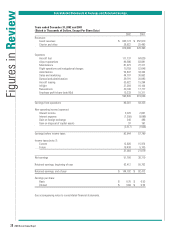

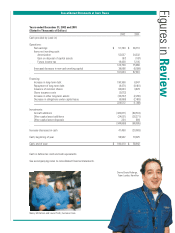

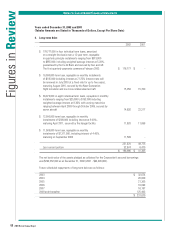

Years ended December 31, 2002 and 2001

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

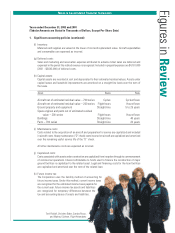

6. Share capital (continued):

(e) Employee Share Purchase Plan:

Under the terms of the Employee Share Purchase Plan, employees may contribute up to a maximum

of 20% of their gross pay and acquire common shares of the Corporation at the current fair market

value of such shares. The Corporation matches the employee contributions and shares may be

withdrawn from the Plan after being held in trust for one year. Employees may offer to sell common

shares, which have not been held for at least one year, on January 1 and July 1 of each year, to the

Corporation for 50% of the then current market price. The Corporation’s share of the contributions is

recorded as compensation expense and amounted to $10,178,000 (2001 - $6,081,000).

(f) Pro forma disclosure:

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option

pricing model with the following weighted average assumptions used for grants in 2002: zero dividend

yield; expected volatility of 38%; risk-free rate of 4.5%; and expected life of four years. The weighted

average fair value of stock options granted during the year was $8.06 per option.

Had the Corporation accounted for employee stock options issued using the fair value based method,

the Corporation’s pro forma net earnings and EPS would be as follows:

As reported 2002 Pro forma 2002

Net earnings $ 51,780 $ 48,963

Earnings per share:

Basic $ 0.70 $ 0.66

Diluted 0.69 0.65

These pro forma earnings reflect compensation cost amortized over the options’ vesting period, which

varies from two to three years.

Figures in Review

Notes to Consolidated Financial Statements

Danielle Hurst, CSA, Victoria

with Sequoia.