Westjet 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 WestJet Annual Report 25

We continue to contract with

tour operators for off-peak

hour charter flying to a vari-

ety of vacation spots, which improves

aircraft and crew utilization and pro-

vides positive net profit to the company.

Charter revenue increased 76.2% from

$10.1 million in 2001 to $17.8 million

in 2002. In 2002 charter revenue

increased to 2.6% of total revenue

compared to 2.1% of total revenue in

2001. Revenue from cargo operations

was up 50.0% to $2.4 million in 2002

from $1.6 million in 2001. Cargo rev-

enue provides incremental revenue, and

will continue to grow at a greater rate

than our scheduled domestic revenues

as we expand our network and fleet.

With significant year-over-year

capacity growth and despite the des-

timulative effect of the federal govern-

ment’s Air Traveller’s Security Charge,

our load factor remained strong at

73.2%, slightly down from 74.7% in

2001. This indicates Canadians

embraced our product as travellers

absorbed the bulk of our 55% capacity

increase during 2002.

WestJet continues to be innovative

and proactive, and in July led the indus-

try in Canada with the introduction of

a three-tiered fee structure, based on

distance flown, for the surcharge levied

by Nav Canada. In January 2003, we

implemented a similar structure of a

$5, $7, and $10 temporary fuel sur-

charge, depending on length of flight,

which was increased to $10, $14, and

$20 in March of 2003. These charges,

as well as the levy for insurance, are

included in our revenues to compen-

sate for increased costs.

As in the past, we continue to grow

our capacity as we add new Next-

Generation 737-700 aircraft to our fleet

and build our network. In keeping with

our strategy of increasing long-haul fly-

ing, our average stage length increased

20.5% from 458 miles in 2001 to 552

miles in 2002. Contributing to our

increased stage length, was our expan-

sion into the Toronto and London,

Ontario markets. By adding these mar-

kets with service to and from western

Canada, we increased our eastern brand

awareness, giving us a stronger plat-

form to continue growing our presence

in this more heavily populated area of

Canada.

As would be expected with our

increasing stage length, costs and rev-

enues on a unit basis declined. We

estimate that this increase in stage

length caused an approximate 7.7%

decline in unit measures of revenue and

costs. Revenue per ASM for the year

declined by 8.8% from 16.0 cents in

2001 to 14.6 cents in 2002 due to the

impact of new fees, taxes, and the

aggressive competitive landscape.

Revenue per passenger mile, or yield,

declined 6.5% from 21.4 cents in 2001

to 20.0 cents in 2002.

Pilot John Swallow and Flight Attendant Laura Maguire

prepare for another fun WestJet flight.

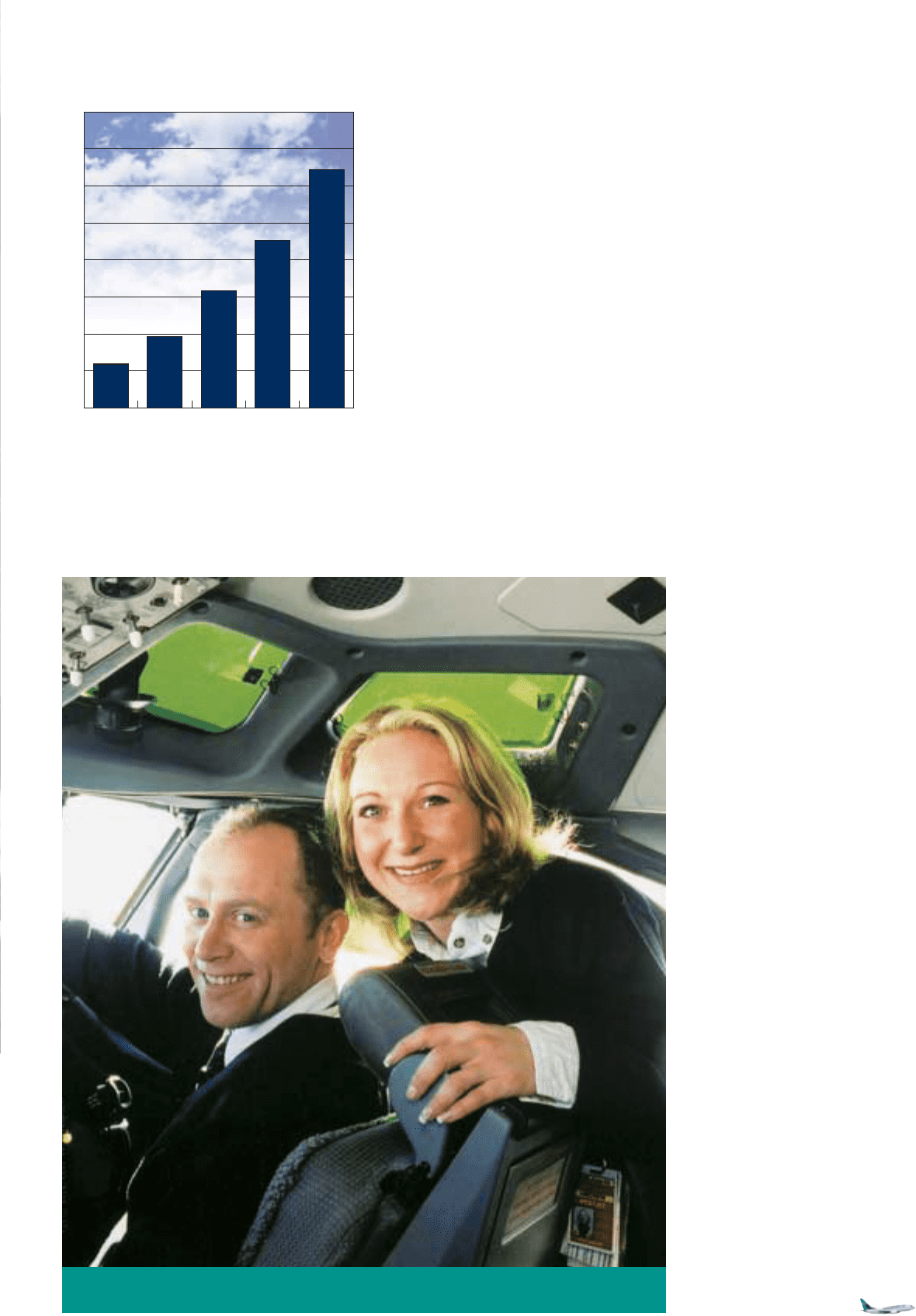

Guest Revenue (Millions of dollars)

0

100

200

300

400

500

600

700

800

118.6

193.7

315.9

452.9

643.2

1998 1999 2000 2001 2002

Dollars & Sense