Westjet 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Figures in Review

Notes to Consolidated Financial Statements

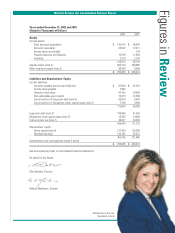

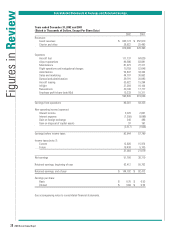

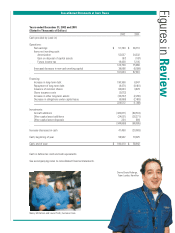

Years ended December 31, 2002 and 2001

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

4. Long-term debt (continued):

The Corporation has a US $478 million facility with the ING Group which is supported by loan

guarantees from the Export-Import Bank of the United States (Ex-Im) for US $478 million for the

purchase of 15 Boeing Next-Generation 737-700 series aircraft. Of these aircraft, four were delivered in

2002, with the remaining 11 to be delivered over the course of 2003. HFLP is used as the financial

intermediary to facilitate the financing agreement to purchase the aircraft.

This facility will be drawn in Canadian dollars in separate instalments with 12-year terms for each new

aircraft. Each loan will be amortized on a straight-line basis over the 12-year term in quarterly principal

instalments, with interest calculated on the outstanding principal balance.

The Corporation is charged a commitment fee of 0.125% per annum on the unutilized and uncancelled

balance of the loan guarantee, payable at specified dates and upon delivery of an aircraft. As at December

31, 2002 the unutilized balance was US $364 million.

The Corporation has entered into Forward Starting Interest Rate Agreements at rates between 5.36%

and 5.85% on the remaining 11 aircraft to be delivered under this facility.

The Corporation has available a facility with a Canadian chartered bank of $6,000,000 for letters of guarantee.

At December 31, 2002, letters of guarantee totaling $4,410,000 have been issued under these facilities.

The credit facilities are secured by a fixed first charge on one aircraft, a general security agreement and

an assignment of insurance proceeds.

Cash interest paid during the year was $5,836,000 (2001 - $5,570,000).

5. Leases:

The Corporation has entered into operating leases for aircraft, buildings, computer hardware and software

licenses and capital leases relating to computer hardware and aircraft. The obligations, on a calendar-

year basis, are as follows (see note 8 for additional lease commitments):

Capital Operating

Leases Leases

2003 $ 8,880 $ 52,715

2004 8,753 51,071

2005 6,256 49,857

2006 2,913 47,341

2007 - 47,206

2008 and thereafter - 384,276

Total lease payments 26,802 $ 632,466

Less imputed interest at 7.79% (3,160)

Net minimum lease payments 23,642

Less current portion of obligations under capital lease (7,290)

Obligations under capital lease $ 16,352

2002 WestJet Annual Report 45