Westjet 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

more business travellers use this

method of booking our product, and

typically book flights closer to their

departure date.

Of our total sales volume booked

through travel agents, approximately

57% is generated through the Internet

and 27% is generated through the call

centre. Our increase in stage length

means that we experience a lower aver-

age unit of revenue, which

similarly produces lower commis-

sions and fees. Our sales and

marketing costs have therefore

moved in that same downward

direction on a unit basis.

GENERAL AND

ADMINISTRATIVE

The US $1.25 per passenger

insurance charge that was imposed

on the airline industry following

the events of September 11, 2001

came into effect in October 2001,

and was eliminated in December

2002. This insurance charge

amounted to $1.9 million in 2001

and represented $8.5 million of

WestJet’s general and administra-

tive expense in 2002. As a result,

WestJet’s total insurance cost rose by

77.9% over 2001 on a per ASM basis,

but was offset by a similar surcharge

which was collected from guests. This

surcharge was included in our revenues.

Other general and administrative

costs are those of Finance, Information

Technology, Legal, Training and

the People Department (our human

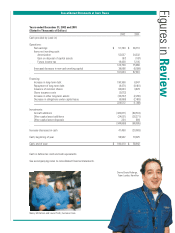

Pilot Shawn Hall can tell you where to go and take you there.

continued operations. Under the new

rules, an impairment loss is recognized

when the carrying amount of a long-

lived asset exceeds the sum of the

undiscounted cash flows expected to

result from its use and eventual

disposition. The impairment loss is rec-

ognized to the extent that the carrying

amount of the long-lived asset exceeds

its fair value. The Corporation does not

believe that this will have any material

effect on the consolidated financial

statements.

In 2002, our amortization expense

increased by 53% over the previous

year to $53 million. Amortization as a

percentage of total operating costs in

2002 was 8.9% as opposed to 8.2% in

2001. This increase can be attributed

to the accelerated amortization of the

200s, the acquisition of the owned 737-

700s, and our investment in equipment,

facilities, and technology.

Throughout 2002, we continued

building on the infrastructure of our

operation through investment in a num-

ber of assets. We ordered a fixed-base

flight trainer and a second 737-700 flight

simulator. We commenced an expansion

of our Calgary hangar, started construc-

tion of a hangar in Hamilton, and

acquired our own ground-handling

equipment in Calgary, which allowed us

to operate our own ground handling

services. We also increased the size of

our 737-700 fleet, and made various

investments in technology.

SALES AND MARKETING

Sales and marketing expenses continue

to show declines in cost per ASM in

2002 with a 6.8% reduction from

2001. This category of costs includes

travel agent commissions, charges from

distribution systems such as Sabre,

advertising and promotional costs, and

credit card fees.

Travel agency bookings account for

approximately 38% of total sales, which

is unchanged from 2001. Travel agents

receive a 9% commission when booking

flights through westjet.com, which

results in a reduced percentage booking

Sales and marketing

expenses continue to

show declines in cost

per available seat mile

in 2002 with a 6.8%

reduction from 2001.

through higher-cost channels such as

our call centre or Sabre where only a

7% commission was earned. Sabre

bookings accounted for 16% of our

travel agency bookings by year-end as

compared with 5% at the end of last

year. This distribution channel gener-

ates fares that are on average over 20%

higher than our regular channels as

Trainer Crystal Graham enjoys working with

WestJet’s newest people.

2002 WestJet Annual Report 29