Westjet 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

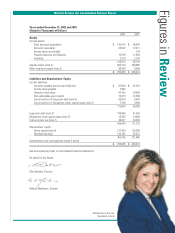

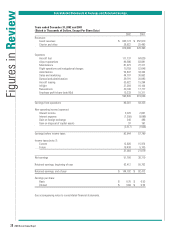

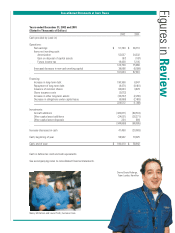

Figures in Review

Notes to Consolidated Financial Statements

Years ended December 31, 2002 and 2001

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

1. Significant accounting policies (continued):

(f) Inventory:

Materials and supplies are valued at the lower of cost and replacement value. Aircraft expendables

and consumables are expensed as incurred.

(g) Deferred costs:

Sales and marketing and reservation expenses attributed to advance ticket sales are deferred and

expensed in the period the related revenue is recognized. Included in prepaid expenses are $4,161,000

(2001 - $3,643,000) of deferred costs.

(h) Capital assets:

Capital assets are recorded at cost and depreciated to their estimated residual values. Assets under

capital leases and leasehold improvements are amortized on a straight-line basis over the term of

the lease.

Asset Basis Rate

Aircraft net of estimated residual value – 700 series Cycles Cycles flown

Aircraft net of estimated residual value – 200 series Flight hours Hours flown

Ground property and equipment Straight-line 5 to 25 years

Spare engines and parts net of estimated residual

value – 200 series Flight hours Hours flown

Buildings Straight-line 40 years

Parts – 700 series Straight-line 20 years

(i) Maintenance costs:

Costs related to the acquisition of an aircraft and preparation for service are capitalized and included

in aircraft costs. Heavy maintenance (“D” check) costs incurred on aircraft are capitalized and amortized

over the remaining useful service life of the “D” check.

All other maintenance costs are expensed as incurred.

(j) Capitalized costs:

Costs associated with assets under construction are capitalized from inception through to commencement

of commercial operations. Interest attributable to funds used to finance the construction of major

ground facilities is capitalized to the related asset. Legal and financing costs for the loan facilities

are capitalized and amortized over the term of the related loan.

(k) Future income tax:

The Corporation uses the liability method of accounting for

future income taxes. Under this method, current income taxes

are recognized for the estimated income taxes payable for

the current year. Future income tax assets and liabilities

are recognized for temporary differences between the

tax and accounting bases of assets and liabilities.

Terri Riddell, Christine Baker, Sandra Rocco,

and Maitreyi Salmon, Flight Attendants