United Healthcare 2013 Annual Report Download - page 98

Download and view the complete annual report

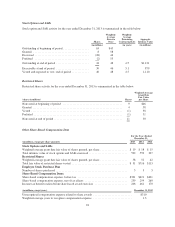

Please find page 98 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2013, the Company had outstanding, undrawn letters of credit with financial institutions of

$39 million and surety bonds outstanding with insurance companies of $499 million, primarily to bond

contractual performance.

Legal Matters

Because of the nature of its businesses, the Company is frequently made party to a variety of legal actions and

regulatory inquiries, including class actions and suits brought by members, care providers, consumer advocacy

organizations, customers and regulators, relating to the Company’s businesses, including management and

administration of health benefit plans and other services. These matters include medical malpractice,

employment, intellectual property, antitrust, privacy and contract claims, and claims related to health care

benefits coverage and other business practices.

The Company records liabilities for its estimates of probable costs resulting from these matters where appropriate.

Estimates of costs resulting from legal and regulatory matters involving the Company are inherently difficult to

predict, particularly where the matters: involve indeterminate claims for monetary damages or may involve fines,

penalties or punitive damages; present novel legal theories or represent a shift in regulatory policy; involve a large

number of claimants or regulatory bodies; are in the early stages of the proceedings; or could result in a change in

business practices. Accordingly, the Company is often unable to estimate the losses or ranges of losses for those

matters where there is a reasonable possibility or it is probable that a loss may be incurred.

Litigation Matters

California Claims Processing Matter. On January 25, 2008, the California Department of Insurance (CDI)

issued an Order to Show Cause to PacifiCare Life and Health Insurance Company, a subsidiary of the Company,

alleging violations of certain insurance statutes and regulations related to an alleged failure to include certain

language in standard claims correspondence, timeliness and accuracy of claims processing, interest payments,

care provider contract implementation, care provider dispute resolution and other related matters. Although the

Company believes that CDI has never issued a penalty in excess of $8 million, CDI has advocated a penalty of

approximately $325 million in this matter. The matter was the subject of an administrative hearing before a

California administrative law judge beginning in December 2009, and in August 2013, the administrative law

judge issued a non-binding proposed decision recommending a penalty in an amount that is not material to the

Company’s results of operations, cash flows or financial condition. The matter is now before the California

Insurance Commissioner, who has indicated that he will not adopt the administrative law judge’s proposed

decision and will issue his own decision. The Commissioner’s decision is subject to challenge in court. The

Company cannot reasonably estimate the range of loss, if any, that may result from this matter given the

procedural status of the dispute, the legal issues presented (including the legal basis for the majority of the

alleged violations), the inherent difficulty in predicting regulatory fines and penalties, and the various remedies

and levels of judicial review available to the Company in the event a fine or penalty is assessed.

Endoscopy Center of Southern Nevada Litigation. In April 2013, a Las Vegas jury awarded $24 million in

compensatory damages and $500 million in punitive damages against a Company health plan and its parent

corporation on the theory that they were negligent in their credentialing and monitoring of an in-network

endoscopy center owned and operated by independent physicians who were subsequently linked by regulators to

an outbreak of hepatitis C. In September 2013, the trial court reduced the overall award to $366 million following

post-trial motions, and in December 2013, the Company filed a notice of appeal. Company plans are party to 41

additional individual lawsuits and two class actions relating to the outbreak. The Company cannot reasonably

estimate the range of loss, if any, that may result from these matters given the likelihood of reversal on appeal,

the availability of statutory and other limits on damages, the novel legal theories being advanced by the plaintiffs,

the various postures of the remaining cases, the availability in many cases of federal defenses under Medicare

law and the Employee Retirement Income Security Act, and the pendency of certain relevant legal questions

before the Nevada Supreme Court. The Company is vigorously defending these lawsuits.

96