United Healthcare 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

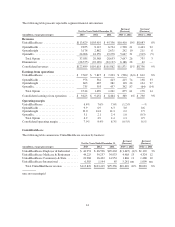

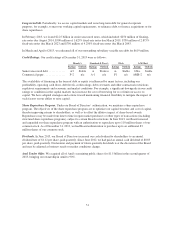

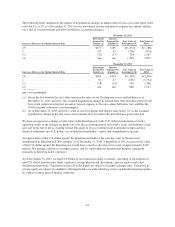

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The following table summarizes future obligations due by period as of December 31, 2013, under our various

contractual obligations and commitments:

(in millions) 2014 2015 to 2016 2017 to 2018 Thereafter Total

Debt (a) ...................................... $2,644 $3,450 $3,411 $18,147 $27,652

Operating leases ............................... 487 800 572 544 2,403

Purchase obligations (b) ......................... 250 174 14 — 438

Future policy benefits (c) ........................ 136 258 267 1,940 2,601

Unrecognized tax benefits (d) .................... — — — 78 78

Other liabilities recorded on the Consolidated Balance

Sheet (e) ................................... 186 43 — 1,482 1,711

Other obligations (f) ............................ 94 113 49 12 268

Redeemable noncontrolling interests (g) ............ 54 158 963 — 1,175

Total contractual obligations ..................... $3,851 $4,996 $5,276 $22,203 $36,326

(a) Includes interest coupon payments and maturities at par or put values. For variable rate debt, the rates in

effect at December 31, 2013 were used to calculate the interest coupon payments. The table also assumes

amounts are outstanding through their contractual term. See Note 8 of Notes to the Consolidated Financial

Statements included in Item 8, “Financial Statements” for more detail.

(b) Includes fixed or minimum commitments under existing purchase obligations for goods and services,

including agreements that are cancelable with the payment of an early termination penalty. Excludes

agreements that are cancelable without penalty and excludes liabilities to the extent recorded in our

Consolidated Balance Sheets as of December 31, 2013.

(c) Future policy benefits represent account balances that accrue to the benefit of the policyholders, excluding

surrender charges, for universal life and investment annuity products and for long-duration health policies

sold to individuals for which some of the premium received in the earlier years is intended to pay benefits to

be incurred in future years. See Note 2 of Notes to the Consolidated Financial Statements included in

Item 8, “Financial Statements” for more detail.

(d) As the timing of future settlements is uncertain, they have been classified as due “Thereafter.”

(e) Includes obligations associated with contingent consideration and other payments related to business

acquisitions, certain employee benefit programs, and various other long-term liabilities. Due to uncertainty

regarding payment timing, obligations for employee benefit programs, charitable contributions and other

liabilities have been classified as “Thereafter.”

(f) Includes remaining capital commitments for venture capital funds and other funding commitments.

(g) Includes commitments for redeemable shares of our subsidiaries, primarily the shares owned by Amil’s

remaining non-public shareholders.

We do not have other significant contractual obligations or commitments that require cash resources. However,

we continually evaluate opportunities to expand our operations, which include internal development of new

products, programs and technology applications, and may include acquisitions.

OFF-BALANCE SHEET ARRANGEMENTS

As of December 31, 2013, we were not involved in any off-balance sheet arrangements, which have or are

reasonably likely to have a material effect on our financial condition, results of operations or liquidity.

RECENTLY ISSUED ACCOUNTING STANDARDS

We have determined that there have been no recently issued, but not yet adopted, accounting standards that will

have a material impact on our Consolidated Financial Statements.

52