United Healthcare 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pricing Trends. We seek to price our health care benefit products consistent with anticipated underlying medical

trends, while balancing growth, margins, and competitive dynamics (such as product positioning and price

competitiveness) and legislative and regulatory changes such as cost increases for the industry fees and tax

provisions of Health Reform Legislation. We continue to expect premium rates to be under pressure from

ongoing market competition in commercial products and from government payment rates. Aggregating

UnitedHealthcare’s businesses, and before giving effect to Health Reform Legislation taxes, we believe the

medical care ratio will rise over time as we continue to grow in the senior and public markets and participate in

the emerging public health benefit exchange market.

In response to Health Reform Legislation, HHS established a review threshold of annual commercial premium

rate increases generally at or above 10% and enacted a new rule requiring the production of information for any

proposed rate increase. HHS review does not supersede existing state review and approval procedures. We have

experienced regulatory challenges to appropriate premium rate increases in several states, including California

and New York. The competitive forces common in our markets do not support unjustifiable rate increases.

Further, our rates and rate filings are developed using methods consistent with the standards of actuarial practices

and we endeavor to sustain a commercial medical care ratio in a stable range for an equivalent mix of business.

We have requested and received rate increases above 10% in a number of markets due to the combination of

medical cost trends and the incremental costs of health care reform. We expect commercial pricing to continue to

be highly competitive. The intensity of pricing competition depends on local market conditions and competitive

dynamics. Overall, the industry has experienced lower medical costs trends due to moderated utilization, which

has impacted pricing trends. Conversely, carriers are generally reflecting the 2014 Health Reform Legislation

industry fees in their pricing. In some markets, competitors have adjusted their pricing to reflect recent medical

cost trend experience as well as the implication of rate review rules and new benefit changes from Health Reform

Legislation. In other areas we are seeing greater price competition due to pricing adjustments and other varied

approaches used by competitors.

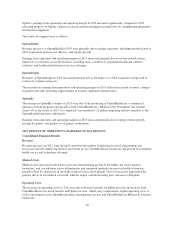

The Medicare Advantage rate structure is changing and funding has been cut in recent years, with additional

reductions to take effect in 2014 and 2015, as discussed below in “Regulatory Trends and Uncertainties.” We

expect these factors to result in year-over-year pressure on gross margin percentages for our Medicare business

during 2014.

States are struggling to balance budget pressures with increases in their Medicaid expenditures. During 2013, rate

changes for some Medicaid programs were slightly negative year-over-year. In general, we expect continued

pressure on net margin percentages due to the Medicaid reimbursement rate environment, which we expect will

remain tight due to the potential non-collectability of the insurer fee primarily related to Medicare Dual SNP

programs and Medicaid. We continue to work with our state customers to advocate for actuarially sound rates

that are commensurate with our medical cost trends, including fees and related taxes, and to take a prudent,

market-sustainable posture for both new bids and maintenance of existing Medicaid contracts.

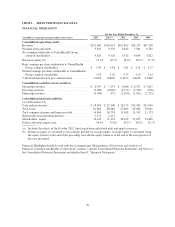

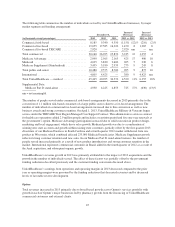

Medical Cost Trends. We expect our 2014 commercial medical cost trend to be in the range of 6.0% plus or

minus 50 basis points, compared to approximately 5% in 2013. In 2014, we expect relatively consistent unit cost

and utilization trends compared to 2013, before taking into account reform impacts. The impact of Health

Reform Legislation and mandates is expected to pressure 2014 medical cost trends. Driving the increases are

mandated essential health benefits and limits on out-of-pocket maximums. Consistent with recent years, our 2014

trend is expected to be driven primarily by continued unit cost pressure from health care providers. We expect

2014 pharmacy trends to be consistent with 2013. The primary drivers of prescription drug trends continue to be

unit cost pressure on brand name drugs and a shift towards expensive new specialty drugs. In recent years, the

recent weak economic environment combined with our medical cost management strategies has had a favorable

impact on utilization trends. We believe the expected stability in the utilization trends in 2014 is influenced by

our medical management strategies, our continued focus on value-based contracting arrangements and greater

consumer engagement.

38