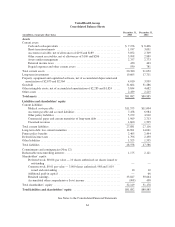

United Healthcare 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

Our provision for income taxes, deferred tax assets and liabilities, and uncertain tax positions reflect our

assessment of estimated future taxes to be paid on items in the consolidated financial statements.

Deferred income taxes arise from temporary differences between financial reporting and tax reporting bases of

assets and liabilities, as well as net operating loss and tax credit carryforwards for tax purposes. We have

established a valuation allowance against certain deferred tax assets for which it is more-likely-than-not that

some portion, or all, of the deferred tax asset will not be realized.

An uncertain tax position is recognized when it is more likely than not that the position will be sustained upon

examination, including resolutions of any related appeals or litigation processes, based on the technical merits.

We prepare and file tax returns based on our interpretation of tax laws and regulations and record estimates based

on these judgments and interpretations. In the normal course of business, our tax returns are subject to

examination by various taxing authorities. Such examinations may result in future tax and interest assessments by

these taxing authorities. Inherent uncertainties exist in estimates of tax positions due to changes in tax law

resulting from legislation, regulation and/or as concluded through the various jurisdictions’ tax court systems.

The significant assumptions and estimates described above are important contributors to our ultimate effective

tax rate in each year. A hypothetical increase or decrease in our effective tax rate by 1% on our 2013 earnings

before income taxes would have caused the provision for income taxes and net earnings to change by $89

million.

Contingent Liabilities

Because of the nature of our businesses, we are routinely involved in various disputes, legal proceedings and

governmental audits and investigations. We record liabilities for our estimates of the probable costs resulting

from these matters where appropriate. Our estimates are developed in consultation with legal counsel, if

appropriate, and are based upon an analysis of potential results, assuming a combination of litigation and

settlement strategies and considering our insurance coverage, if any, for such matters.

Estimates of costs resulting from legal and regulatory matters are inherently difficult to predict, particularly

where the matters: involve indeterminate claims for monetary damages or may involve fines, penalties or

punitive damages; present novel legal theories or represent a shift in regulatory policy; involve a large number of

claimants or regulatory bodies; are in the early stages of the proceedings; or could result in a change in business

practices. Accordingly, in many cases, we are unable to estimate the losses or ranges of losses for those matters

where there is a reasonable possibility or it is probable that a loss may be incurred. Similarly, the assessment of

the likelihood of assertion of unasserted claims involves significant judgment.

Given this inherent uncertainty, it is possible that future results of operations for any particular quarterly or

annual period could be materially affected by changes in our estimates or assumptions. We evaluate our related

disclosures in each reporting period. See Note 12 of Notes to the Consolidated Financial Statements included in

Item 8, “Financial Statements” for a discussion of specific legal proceedings including an assessment of whether

a reasonable estimate of the losses or range of loss could be determined.

LEGAL MATTERS

A description of our legal proceedings is presented in Note 12 of Notes to the Consolidated Financial Statements

included in Item 8, “Financial Statements.”

CONCENTRATIONS OF CREDIT RISK

Investments in financial instruments such as marketable securities and accounts receivable may subject us to

concentrations of credit risk. Our investments in marketable securities are managed under an investment policy

59