United Healthcare 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CRITICAL ACCOUNTING ESTIMATES

Critical accounting estimates are those estimates that require management to make challenging, subjective or

complex judgments, often because they must estimate the effects of matters that are inherently uncertain and may

change in subsequent periods. Critical accounting estimates involve judgments and uncertainties that are

sufficiently sensitive and may result in materially different results under different assumptions and conditions.

Medical Costs Payable

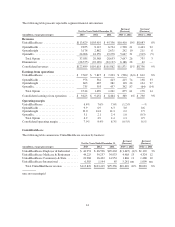

Each reporting period, we estimate our obligations for medical care services that have been rendered on behalf of

insured consumers but for which claims have either not yet been received or processed and for liabilities for

physician, hospital and other medical cost disputes. We develop estimates for medical care services incurred but

not reported using an actuarial process that is consistently applied, centrally controlled and automated. The

actuarial models consider factors such as time from date of service to claim receipt, claim processing backlogs,

seasonal variances in medical care consumption, health care professional contract rate changes, medical care

utilization and other medical cost trends, membership volume and demographics, the introduction of new

technologies, benefit plan changes, and business mix changes related to products, customers and geography.

Depending on the health care professional and type of service, the typical billing lag for services can be up to 90

days from the date of service. Substantially all claims related to medical care services are known and settled

within nine to twelve months from the date of service. As of December 31, 2013, our days outstanding in medical

payables was 47 days, calculated as total medical payables divided by total medical costs times 365 days.

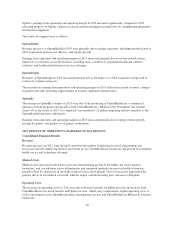

Each period, we re-examine previously established medical costs payable estimates based on actual claim

submissions and other changes in facts and circumstances. As more complete claim information becomes

available, we adjust the amount of the estimates and include the changes in estimates in medical costs in the

period in which the change is identified. Therefore, in every reporting period, our operating results include the

effects of more completely developed medical costs payable estimates associated with previously reported

periods. If the revised estimate of prior period medical costs is less than the previous estimate, we will decrease

reported medical costs in the current period (favorable development). If the revised estimate of prior period

medical costs is more than the previous estimate, we will increase reported medical costs in the current period

(unfavorable development). Medical costs in 2013, 2012, and 2011 included favorable medical cost development

related to prior years of $680 million, $860 million and $720 million, respectively.

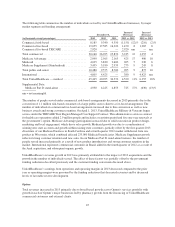

In developing our medical costs payable estimates, we apply different estimation methods depending on the

month for which incurred claims are being estimated. For example, we actuarially calculate completion factors

using an analysis of claim adjudication patterns over the most recent 36-month period. A completion factor is an

actuarial estimate, based upon historical experience and analysis of current trends, of the percentage of incurred

claims during a given period that have been adjudicated by us at the date of estimation. For months prior to the

most recent three months, we apply the completion factors to actual claims adjudicated-to-date to estimate the

expected amount of ultimate incurred claims for those months. For the most recent three months, we estimate

claim costs incurred primarily by applying observed medical cost trend factors to the average per member per

month (PMPM) medical costs incurred in prior months for which more complete claim data is available,

supplemented by a review of near-term completion factors.

Completion factors. Completion factors are the most significant factors we use in developing our medical costs

payable estimates for older periods, generally periods prior to the most recent three months. Completion factors

include judgments in relation to claim submissions such as the time from date of service to claim receipt, claim

inventory levels and claim processing backlogs as well as other factors. If actual claims submission rates from

providers (which can be influenced by a number of factors including provider mix and electronic versus manual

submissions) or our claim processing patterns are different than estimated, our reserves may be significantly

impacted.

53