United Healthcare 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

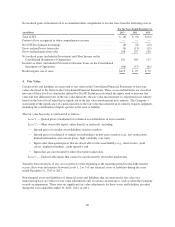

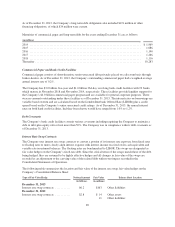

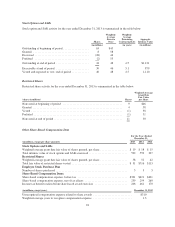

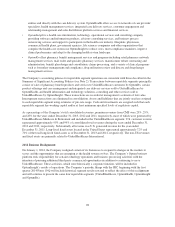

The following table provides a summary of the effect of changes in fair value of fair value hedges on the

Company’s Consolidated Statements of Operations:

For the Years Ended December 31,

(in millions) 2013 2012 2011

Hedge — interest rate swap (loss) gain recognized in interest expense ......... $(166) $ 3 $ 190

Hedged item — long-term debt gain (loss) recognized in interest expense ...... 166 (3) (190)

Net impact on the Company’s Consolidated Statements of Operations ......... $ — $ — $ —

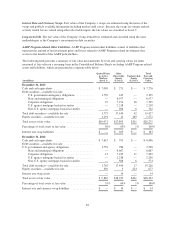

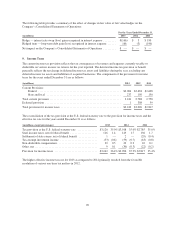

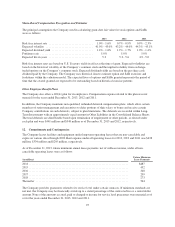

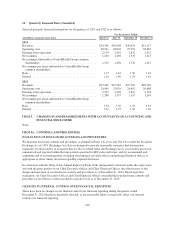

9. Income Taxes

The current income tax provision reflects the tax consequences of revenues and expenses currently taxable or

deductible on various income tax returns for the year reported. The deferred income tax provision or benefit

generally reflects the net change in deferred income tax assets and liabilities during the year, excluding any

deferred income tax assets and liabilities of acquired businesses. The components of the provision for income

taxes for the years ended December 31 are as follows:

(in millions) 2013 2012 2011

Current Provision:

Federal .......................................................... $3,004 $2,638 $2,608

State and local .................................................... 237 150 150

Total current provision .................................................. 3,241 2,788 2,758

Deferred provision ..................................................... 1 308 59

Total provision for income taxes .......................................... $3,242 $3,096 $2,817

The reconciliation of the tax provision at the U.S. federal statutory rate to the provision for income taxes and the

effective tax rate for the years ended December 31 is as follows:

(in millions, except percentages) 2013 2012 2011

Tax provision at the U.S. federal statutory rate .............. $3,120 35.0% $3,018 35.0% $2,785 35.0%

State income taxes, net of federal benefit ................... 126 1.4 143 1.7 136 1.7

Settlement of state exams, net of federal benefit ............. 1 — 2 — (29) (0.4)

Tax-exempt investment income .......................... (53) (0.6) (59) (0.7) (63) (0.8)

Non-deductible compensation ............................ 39 0.5 22 0.2 10 0.1

Other, net ............................................ 9 0.1 (30) (0.3) (22) (0.2)

Provision for income taxes .............................. $3,242 36.4% $3,096 35.9% $2,817 35.4%

The higher effective income tax rate for 2013 as compared to 2012 primarily resulted from the favorable

resolution of various one-time tax matters in 2012.

90