United Healthcare 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

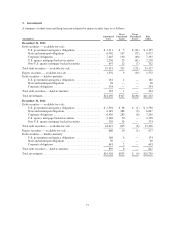

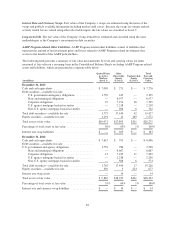

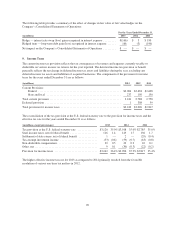

The following table presents a summary of fair value measurements by level and carrying values for certain

financial instruments not measured at fair value on a recurring basis in the Consolidated Balance Sheets:

(in millions)

Quoted Prices

in Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Total

Fair

Value

Total

Carrying

Value

December 31, 2013

Debt securities—held-to-maturity:

U.S. government and agency obligations .... $182 $ — $ — $ 182 $ 181

State and municipal obligations ............ — — 28 28 28

Corporate obligations ................... 47 9 278 334 334

Total debt securities—held-to-maturity ......... $229 $ 9 $306 $ 544 $ 543

Long-term debt and other financing obligations . . . $ — $16,602 $ — $16,602 $15,745

December 31, 2012

Debt securities—held-to-maturity:

U.S. government and agency obligations .... $174 $ — $ — $ 174 $ 168

State and municipal obligations ............ — 1 29 30 30

Corporate obligations ................... 10 346 287 643 641

Total debt securities—held-to-maturity ......... $184 $ 347 $316 $ 847 $ 839

Long-term debt ............................ $ — $17,034 $ — $17,034 $15,167

The carrying amounts reported in the Consolidated Balance Sheets for other current financial assets and

liabilities approximate fair value because of their short-term nature. These assets and liabilities are not listed in

the table above.

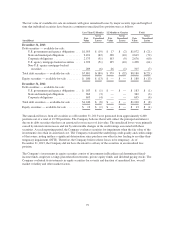

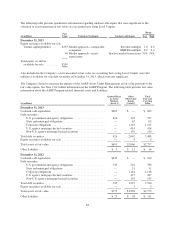

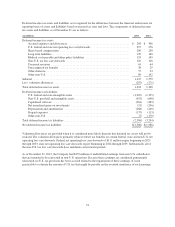

A reconciliation of the beginning and ending balances of assets measured at fair value on a recurring basis using

Level 3 inputs is as follows:

December 31, 2013 December 31, 2012 December 31, 2011

(in millions)

Debt

Securities

Equity

Securities Total

Debt

Securities

Equity

Securities Total

Debt

Securities

Equity

Securities Total

Balance at beginning of period ..... $17 $224 $241 $ 208 $209 $ 417 $141 $208 $349

Purchases ..................... 38 71 109 11 71 82 92 35 127

Sales ......................... (10) (25) (35) — (34) (34) — (17) (17)

Settlements .................... — — — (1) — (1) (25) (7) (32)

Net unrealized losses in accumulated

other comprehensive income .... (2) (7) (9) — (14) (14) — (4) (4)

Net realized (losses) gains in

investment and other income .... (1) 6 5 — 13 13 — (6) (6)

Transfers to held-to-maturity ...... — — — (201) (21) (222) — — —

Balance at end of period .......... $42 $269 $311 $ 17 $224 $ 241 $208 $209 $417

83