United Healthcare 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

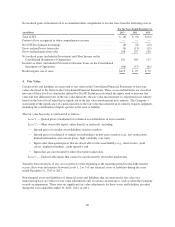

Interest Rate and Currency Swaps. Fair values of the Company’s swaps are estimated using the terms of the

swaps and publicly available information including market yield curves. Because the swaps are unique and not

actively traded but are valued using other observable inputs, the fair values are classified as Level 2.

Long-term Debt. The fair value of the Company’s long-term debt is estimated and classified using the same

methodologies as the Company’s investments in debt securities.

AARP Program-related Other Liabilities. AARP Program-related other liabilities consist of liabilities that

represent the amount of net investment gains and losses related to AARP Program-related investments that

accrue to the benefit of the AARP policyholders.

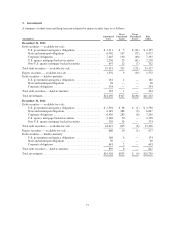

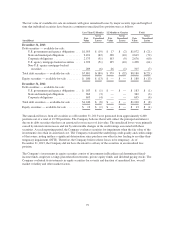

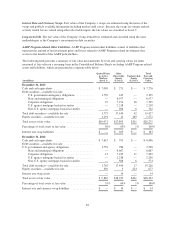

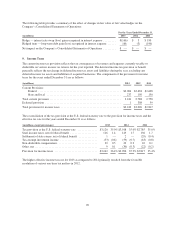

The following table presents a summary of fair value measurements by level and carrying values for items

measured at fair value on a recurring basis in the Consolidated Balance Sheets excluding AARP Program-related

assets and liabilities, which are presented in a separate table below:

(in millions)

Quoted Prices

in Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Total

Fair and

Carrying

Value

December 31, 2013

Cash and cash equivalents ............................ $ 7,005 $ 271 $ — $ 7,276

Debt securities—available-for-sale:

U.S. government and agency obligations ............. 1,750 445 — 2,195

State and municipal obligations .................... — 6,977 — 6,977

Corporate obligations ............................ 25 7,274 36 7,335

U.S. agency mortgage-backed securities ............. — 2,218 — 2,218

Non-U.S. agency mortgage-backed securities ......... — 696 6 702

Total debt securities—available-for-sale ................. 1,775 17,610 42 19,427

Equity securities—available-for-sale .................... 1,291 12 269 1,572

Total assets at fair value .............................. $10,071 $17,893 $311 $28,275

Percentage of total assets at fair value ................... 36% 63% 1% 100%

Interest rate swap liabilities ........................... $ — $ 163 $ — $ 163

December 31, 2012

Cash and cash equivalents ............................ $ 7,615 $ 791 $ — $ 8,406

Debt securities—available-for-sale: .....................

U.S. government and agency obligations 1,752 786 — 2,538

State and municipal obligations .................... — 6,667 — 6,667

Corporate obligations ............................ 13 7,185 11 7,209

U.S. agency mortgage-backed securities ............. — 2,238 — 2,238

Non-U.S. agency mortgage-backed securities ......... — 568 6 574

Total debt securities—available-for-sale ................. 1,765 17,444 17 19,226

Equity securities—available-for-sale .................... 450 3 224 677

Interest rate swap assets .............................. — 14 — 14

Total assets at fair value .............................. $ 9,830 $18,252 $241 $28,323

Percentage of total assets at fair value ................... 35% 64% 1% 100%

Interest rate and currency swap liabilities ................ $ — $ 14 $ — $ 14

82