United Healthcare 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

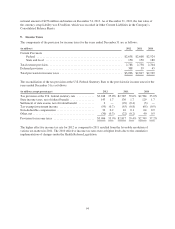

notional amount of $256 million and mature on December 31, 2013. As of December 31, 2012, the fair value of

the currency swap liability was $3 million, which was recorded in Other Current Liabilities in the Company’s

Consolidated Balance Sheets.

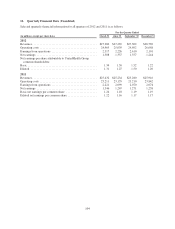

9. Income Taxes

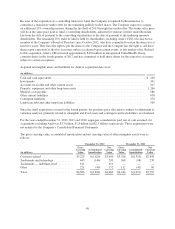

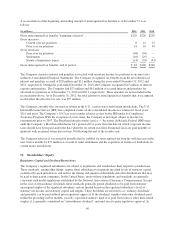

The components of the provision for income taxes for the years ended December 31 are as follows:

(in millions) 2012 2011 2010

Current Provision:

Federal .......................................................... $2,638 $2,608 $2,524

State and local .................................................... 150 150 180

Total current provision .................................................. 2,788 2,758 2,704

Deferred provision ..................................................... 308 59 45

Total provision for income taxes .......................................... $3,096 $2,817 $2,749

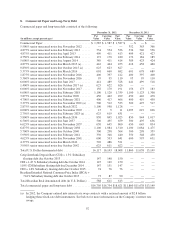

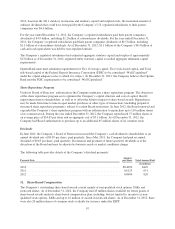

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes for the

years ended December 31 is as follows:

(in millions, except percentages) 2012 2011 2010

Tax provision at the U.S. federal statutory rate ............ $3,018 35.0% $2,785 35.0% $2,584 35.0%

State income taxes, net of federal benefit ................. 143 1.7 136 1.7 129 1.7

Settlement of state exams, net of federal benefit ........... 2 — (29) (0.4) (3) —

Tax-exempt investment income ........................ (59) (0.7) (63) (0.8) (65) (0.9)

Non-deductible compensation .......................... 22 0.2 10 0.1 64 0.9

Other, net .......................................... (30) (0.3) (22) (0.2) 40 0.5

Provision for income taxes ............................ $3,096 35.9% $2,817 35.4% $2,749 37.2%

The higher effective income tax rate for 2012 as compared to 2011 resulted from the favorable resolution of

various tax matters in 2011. The 2010 effective income tax rates were at higher levels due to the cumulative

implementation of changes under the Health Reform Legislation.

94