United Healthcare 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

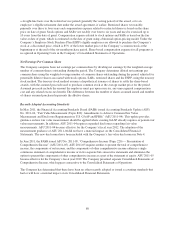

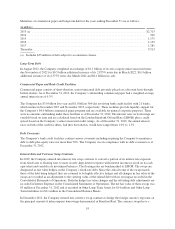

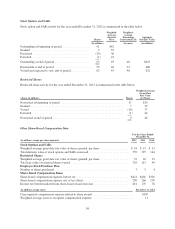

5. Property, Equipment and Capitalized Software

A summary of property, equipment and capitalized software is as follows:

(in millions)

December 31,

2012

December 31,

2011

Land and improvements ................................................. $ 358 $ 45

Buildings and improvements ............................................. 1,910 1,052

Computer equipment ................................................... 1,447 1,345

Furniture and fixtures ................................................... 488 274

Less accumulated depreciation ........................................... (1,542) (1,424)

Property and equipment, net ............................................. 2,661 1,292

Capitalized software .................................................... 2,300 2,239

Less accumulated amortization ........................................... (1,022) (1,016)

Capitalized software, net ................................................ 1,278 1,223

Total property, equipment and capitalized software, net ........................ $3,939 $ 2,515

Depreciation expense for property and equipment for 2012, 2011 and 2010 was $449 million, $386 million and

$398 million, respectively. Amortization expense for capitalized software for 2012, 2011 and 2010 was $412

million, $377 million and $349 million, respectively.

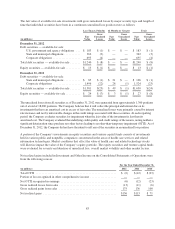

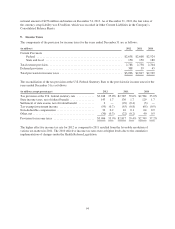

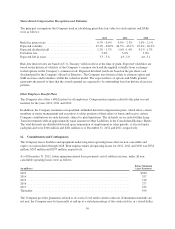

6. Goodwill and Other Intangible Assets

Changes in the carrying amount of goodwill, by reportable segment, were as follows:

(in millions) UnitedHealthcare OptumHealth OptumInsight OptumRx Consolidated

Balance at January 1, 2011 ................. $17,837 $ 760 $3,308 $840 $22,745

Acquisitions ............................ 101 1,353 — — 1,454

Dispositions ............................. (2) — (214) — (216)

Adjustments, net ......................... (4) — (4) — (8)

Balance at December 31, 2011 .............. 17,932 2,113 3,090 840 23,975

Acquisitions ............................ 6,557 705 98 — 7,360

Adjustments and foreign currency effects, net . . . (30) — (19) — (49)

Balance at December 31, 2012 .............. $24,459 $2,818 $3,169 $840 $31,286

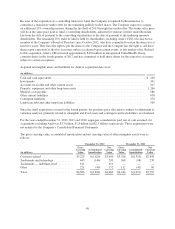

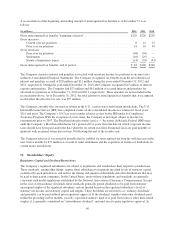

In October 2012, the Company purchased approximately 60% of the outstanding shares of Amil for

approximately $3.2 billion in a private transaction. Later in the fourth quarter of 2012, the Company purchased

an additional 17.8 million shares of Amil for $0.3 billion, bringing the stake in Amil attributable to the Company

to approximately 65% of Amil’s outstanding shares. Amil is a health care company located in Brazil, providing

health and dental benefits, hospital and clinical services, and advanced care management resources to more than

5 million people. The total consideration paid and fair value of the noncontrolling interest exceeded the estimated

fair value of the net tangible assets acquired by $5.9 billion, of which $1.0 billion has been allocated to finite-

lived intangible assets, $0.6 billion to indefinite-lived intangible assets and $4.3 billion to goodwill. To estimate

the acquisition date fair value of the noncontrolling interest of $2.2 billion, the Company utilized the public share

price as of the date of acquisition. Contingent liabilities were measured based on the probable amount that could

be reasonably estimated. The results of operations and financial condition of Amil have been included in the

Company’s consolidated results and the results of the UnitedHealthcare reportable segment since the acquisition

date. The pro-forma effects of this acquisition on the Company’s results of operations were not material. In

conjunction with the 2012 purchases, the Company generated Brazilian tax deductible goodwill of approximately

$2.7 billion.

89