United Healthcare 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

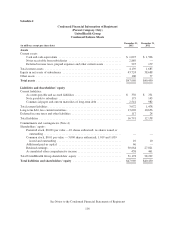

Schedule I

Condensed Financial Information of Registrant

(Parent Company Only)

UnitedHealth Group

Notes to Condensed Financial Statements

1. Basis of Presentation

UnitedHealth Group’s parent company financial information has been derived from its consolidated financial

statements and should be read in conjunction with the consolidated financial statements included in this

Form 10-K. The accounting policies for the registrant are the same as those described in the Summary of

Significant Accounting Policies in Note 2 of Notes to the Consolidated Financial Statements included in Item 8,

“Financial Statements.”

2. Subsidiary Transactions

Investment in Subsidiaries. UnitedHealth Group’s investment in subsidiaries is stated at cost plus equity in

undistributed earnings of subsidiaries.

Notes Receivable from Subsidiaries. Notes issued to subsidiaries were used primarily to fund acquisitions.

During 2012, the parent company completed a non-cash exchange of a $3.9 billion intercompany note to a

subsidiary for a new term note of $2.6 billion and an equity interest of $1.3 billion.

Dividends. Cash dividends received from subsidiaries and included in Cash Flows from Operating Activities in

the Condensed Statements of Cash Flows were $7.8 billion, $5.6 billion and $4.3 billion in 2012, 2011 and 2010,

respectively.

3. Commercial Paper and Long-Term Debt

Maturities of commercial paper and long-term debt for the years ending December 31 are as follows:

(in millions)

2013 (a) ............................................................................. $2,541

2014 ................................................................................ 589

2015 ................................................................................ 1,067

2016 ................................................................................ 1,152

2017 ................................................................................ 1,281

Thereafter ............................................................................ 9,513

(a) Includes $9 million of debt subject to acceleration clauses.

Long-term debt obligations of the parent company do not include Brazilian real denominated debt of a subsidiary

with a total par value of $588 million. Further information on commercial paper and long-term debt can be found

in Note 8 of Notes to the Consolidated Financial Statements included in Item 8, “Financial Statements.”

4. Commitments and Contingencies

For a summary of commitments and contingencies, see Note 12 of Notes to the Consolidated Financial

Statements included in Item 8, “Financial Statements.”

119