United Healthcare 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.changes in the reported market values and returns to relevant market indices to test the reasonableness of the

reported prices. The Company’s internal price verification procedures and reviews of fair value methodology

documentation provided by independent pricing services have not historically resulted in adjustment in the prices

obtained from the pricing service.

Fair values of debt securities that do not trade on a regular basis in active markets but are priced using other

observable inputs are classified as Level 2.

Fair value estimates for Level 1 and Level 2 equity securities are based on quoted market prices for actively

traded equity securities and/or other market data for the same or comparable instruments and transactions in

establishing the prices.

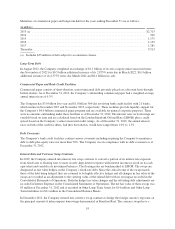

The Company’s Level 3 equity securities are primarily investments in venture capital securities. The fair values

of Level 3 investments in venture capital portfolios are estimated using a market valuation technique that relies

heavily on management assumptions and qualitative observations. Under the market approach, the fair values of

the Company’s various venture capital investments are computed using limited quantitative and qualitative

observations of activity for similar companies in the current market. The Company’s market modeling utilizes, as

applicable, transactions for comparable companies in similar industries and having similar revenue and growth

characteristics; and similar preferences in their capital structure. Key significant unobservable inputs in the

market technique include implied earnings before interest, taxes, depreciation and amortization (EBITDA)

multiples and revenue multiples. Additionally, the fair value of certain of the Company’s venture capital

securities are based off of recent transactions in inactive markets for identical or similar securities. Significant

changes in any of these inputs could result in significantly lower or higher fair value measurements.

Throughout the procedures discussed above in relation to the Company’s processes for validating third party

pricing information, the Company validates the understanding of assumptions and inputs used in security pricing

and determines the proper classification in the hierarchy based on that understanding.

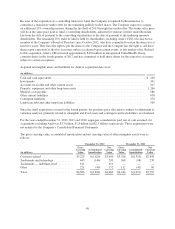

AARP Program-related Investments. AARP Program-related investments consist of debt and equity securities

held to fund costs associated with the AARP Program and are priced and classified using the same methodologies

as the Company’s debt and equity securities.

Interest Rate and Currency Swaps. Fair values of the Company’s swaps are estimated using the terms of the

swaps and publicly available information including market yield curves. Because the swaps are unique and not

actively traded but are valued using other observable inputs, the fair values are classified as Level 2.

Long-term debt. The fair value of the Company’s long-term debt is estimated and classified using the same

methodologies as the Company’s investments in debt securities.

AARP Program-related Other Liabilities. AARP Program-related other liabilities consist of liabilities that

represent the amount of net investment gains and losses related to AARP Program-related investments that

accrue to the benefit of the AARP policyholders.

85