United Healthcare 2012 Annual Report Download - page 48

Download and view the complete annual report

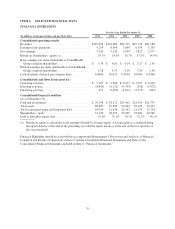

Please find page 48 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• $1.1 billion in cash was held by non-regulated entities as of December 31, 2012.

• 2012 debt offerings amounted to $4 billion, including the August debt exchange.

• Cash paid for acquisitions in 2012, net of cash assumed, totaled $6.5 billion, including the fourth quarter

acquisition of approximately 65% of the outstanding shares of Amil. We also plan to acquire an additional

25% of Amil in the first half of 2013. See Note 6 of Notes to the Consolidated Financial Statements

included in Item 8, “Financial Statements” for further detail on Amil.

• We repurchased 57 million shares for $3.1 billion and paid dividends of $0.8 billion.

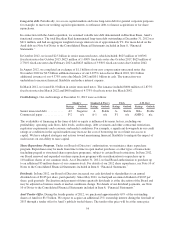

2012 RESULTS OF OPERATIONS COMPARED TO 2011 RESULTS

Consolidated Financial Results

Revenues

Revenue increases in 2012 were driven by growth in the number of individuals served and premium rate

increases related to underlying medical cost trends in our UnitedHealthcare businesses and growth in our Optum

health service and technology offerings.

Medical Costs

Medical costs increased in 2012 due to risk-based membership growth in our public and senior markets

businesses, unit cost inflation across all businesses and continued moderate increases in health system use,

partially offset by an increase in favorable medical reserve development. Unit cost increases represented the

primary driver of our medical cost trend, with the largest contributor being price increases to hospitals.

Operating Costs

The increases in our operating costs for 2012 were due to business growth, including increases in revenues from

UnitedHealthcare fee-based benefits and Optum services, which carry comparatively higher operating costs, as

well as investments in the OptumRx pharmacy management services and UnitedHealthcare Military & Veterans

businesses.

Income Tax Rate

The increase in our effective income tax rate for 2012 was due to the favorable resolution of various tax matters

in 2011, which lowered the 2011 effective income tax rate.

Reportable Segments

We have four reportable segments across our two business platforms, UnitedHealthcare and Optum:

• UnitedHealthcare, which includes UnitedHealthcare Employer & Individual, UnitedHealthcare Medicare &

Retirement, UnitedHealthcare Community & State, and UnitedHealthcare International;

• OptumHealth;

• OptumInsight; and

• OptumRx.

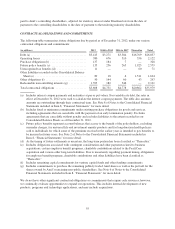

See Note 13 of Notes to the Consolidated Financial Statements included in Item 8, “Financial Statements” and

Item 1, “Business” for a description of how each of our reportable segments derives its revenues.

Transactions between reportable segments principally consist of sales of pharmacy benefit products and services

to UnitedHealthcare customers by OptumRx, certain product offerings and care management and integrated care

delivery services sold to UnitedHealthcare by OptumHealth, and health information and technology solutions,

consulting and other services sold to UnitedHealthcare by OptumInsight. These transactions are recorded at

management’s estimate of fair value. Intersegment transactions are eliminated in consolidation.

46