United Healthcare 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

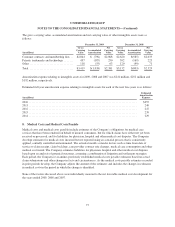

As further discussed in Note 11 of Notes to the Consolidated Financial Statements, the Company maintains a

share repurchase program. The objectives of the share repurchase program are to optimize the Company’s capital

structure, cost of capital and return to shareholders, as well as to offset the dilutive impact of shares issued for

share-based award exercises.

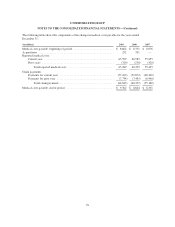

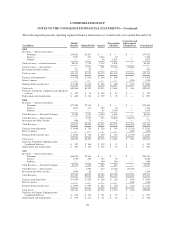

Other Employee Benefit Plans

The Company also offers a 401(k) plan for all employees. Compensation expense related to this plan was not

significant for the years 2009, 2008 and 2007.

The Company has provided Supplemental Executive Retirement Plan (SERP) benefits, which are non-qualified

defined benefit plans, for its CEO, as well as for certain nonexecutive officers under plans that were assumed in

acquisitions. No additional amounts are accruing to the SERP for the Company’s CEO. The SERPs are

non-contributory, unfunded and provide benefits based on years of service and compensation during

employment. The total SERP liability as of December 31, 2009 was $20 million, which was recorded in Other

Liabilities in the Consolidated Balance Sheets. The total SERP liability as of December 31, 2008 was $159

million, of which $51 million was recorded in Accounts Payable and Accrued Liabilities and $108 million was

recorded in Other Liabilities in the Consolidated Balance Sheets. In 2009, a SERP accrual of $91 million

relating to the Company’s former CEO was reversed as a result of the resolution of the SEC settlement pertaining

to the stock option matter. See Note 14 of Notes to the Consolidated Financial Statements for further discussion

of stock option matters.

In addition, the Company maintains non-qualified, unfunded deferred compensation plans, which allow certain

members of senior management and executives to defer portions of their salary or bonus and receive certain

Company contributions on such deferrals, subject to plan limitations. The deferrals are recorded within Long-

Term Investments with an approximately equal amount in Other Liabilities in the Consolidated Balance Sheets.

The total deferrals are distributable based upon termination of employment or other periods, as elected under

each plan and were $216 million and $182 million as of December 31, 2009 and 2008, respectively.

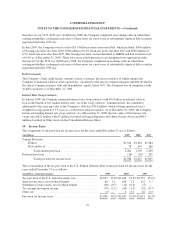

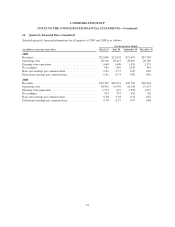

13. AARP

The Company provides health insurance products and services to members of AARP under a Supplemental

Health Insurance Program (the Program), and separate Medicare Advantage and Medicare Part D arrangements.

The products and services under the Program include supplemental Medicare benefits (AARP Medicare

Supplement Insurance), hospital indemnity insurance, including insurance for individuals between 50 to 64 years

of age, and other related products.

In October 2007, the Company entered into four agreements with AARP, effective January 1, 2008, that

amended its existing AARP arrangements. These agreements extended the Company’s arrangements with AARP

on the Program to December 31, 2017, extended the Company’s arrangement with AARP on the Medicare Part D

business to December 31, 2014, and gave the Company an exclusive right to use the AARP brand on the

Company’s Medicare Advantage offerings until December 31, 2014, subject to certain limited exclusions.

Under the Program, the Company is compensated for transaction processing and other services, as well as for

assuming underwriting risk. The Company is also engaged in product development activities to complement the

insurance offerings. Premium revenues from the Company’s portion of the Program for 2009, 2008 and 2007

were $6.0 billion, $5.7 billion and $5.3 billion, respectively.

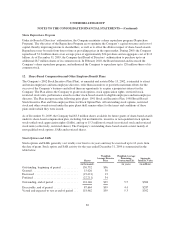

The Company’s agreement with AARP on the Program provides for the maintenance of the Rate Stabilization

Fund (RSF) that is held by the Company on behalf of policyholders. Underwriting gains or losses related to the

85