United Healthcare 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

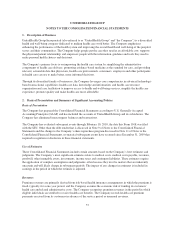

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

recognizes and measures in its financial statements the identifiable assets acquired, the liabilities, any

noncontrolling interest in the acquiree and the goodwill acquired. The guidance as amended includes recognition

provisions for assets acquired and liabilities assumed that arise from contingencies and the treatment of

contingent purchase price. It also requires additional disclosure requirements intended to enable users to evaluate

the nature and financial effects of the business combination. The Company adopted the new guidance on

January 1, 2009, and applied the provisions prospectively to all new acquisitions closing on or after that date. The

adoption did not have a material impact on the Consolidated Financial Statements.

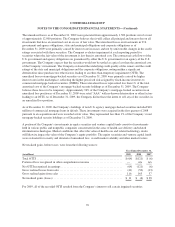

Recently Issued Accounting Standards. In October 2009, the FASB issued Accounting Standards Update (ASU)

No. 2009-13, “Multiple-Deliverable Revenue Arrangements” (ASU 2009-13). This update removes the criterion

that entities must use objective and reliable evidence of fair value in separately accounting for deliverables and

provides entities with a hierarchy of evidence that must be considered when allocating arrangement

consideration. The new guidance also requires entities to allocate arrangement consideration to the separate units

of accounting based on the deliverables’ relative selling price. The provisions will be effective for revenue

arrangements entered into or materially modified in the Company’s fiscal year 2011 and must be applied

prospectively. The Company is currently evaluating the impact of the provisions of ASU 2009-13.

The Company has determined that all other recently issued accounting standards will not have a material impact

on its Consolidated Financial Statements, or do not apply to its operations.

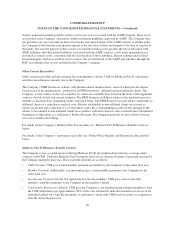

3. Acquisitions

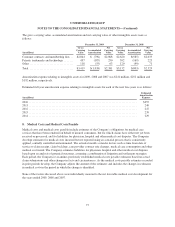

On June 1, 2009, all of the outstanding shares of AIM Healthcare Services, Inc. (AIM) were acquired for

approximately $440 million in cash. AIM is a leading provider of payment accuracy solutions for health care

payer and hospital clients in all 50 states. On a preliminary basis, the total consideration paid exceeded the

estimated fair value of the net tangible assets acquired by $425 million, of which $166 million has been allocated

to finite-lived intangible assets and $259 million to goodwill. The allocation is pending completion of a valuation

analysis. The acquired goodwill is deductible for income tax purposes. The results of operations and financial

condition of AIM have been included in the Company’s consolidated results and the results of the Ingenix

reporting segment since the acquisition date. The pro forma effects of this acquisition on the Company’s

Consolidated Financial Statements were not material.

On May 30, 2008, the Company acquired all the outstanding shares of Unison Health Plans (Unison) for

approximately $930 million in cash. Unison provides government-sponsored health plan coverage to people in

Pennsylvania, Ohio, Tennessee, Delaware, South Carolina and Washington, D.C. through a network of

independent health care professionals. The total consideration paid exceeded the estimated fair value of the net

tangible assets acquired by $806 million, of which $89 million has been allocated to finite-lived intangible assets

and $717 million to goodwill. The acquired goodwill is not deductible for income tax purposes. The results of

operations and financial condition of Unison have been included in the Company’s consolidated results and the

results of the Health Benefits reporting segment since the acquisition date. The pro forma effects of this

acquisition on the Company’s Consolidated Financial Statements were not material.

On February 25, 2008, the Company acquired all of the outstanding shares of Sierra Health Services, Inc.

(Sierra), a diversified health care services company based in Las Vegas, Nevada, for approximately $2.6 billion

in cash, representing a price of $43.50 per share of Sierra common stock. The total consideration paid exceeded

the estimated fair value of the net tangible assets acquired by $2.5 billion. Based on management’s consideration

of fair value, which included completion of a valuation analysis, $500 million has been allocated to finite-lived

intangible assets and $2.0 billion to goodwill. The acquired goodwill is not deductible for income tax purposes.

65