United Healthcare 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

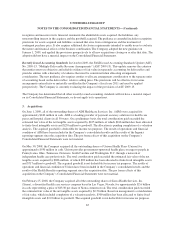

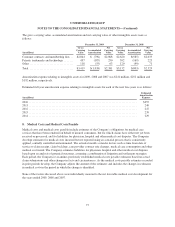

The unrealized losses as of December 31, 2009 were generated from approximately 1,500 positions out of a total

of approximately 12,000 positions. The Company believes that it will collect all principal and interest due on all

investments that have an amortized cost in excess of fair value. The unrealized losses on investments in U.S.

government and agency obligations, state and municipal obligations and corporate obligations as of

December 31, 2009 were primarily caused by interest rate increases and not by unfavorable changes in the credit

ratings associated with these securities. The Company evaluates impairment at each reporting period for

securities where the fair value of the investment is less than its amortized cost. The contractual cash flows of the

U.S. government and agency obligations are guaranteed by either the U.S. government or an agency of the U.S.

government. The Company expects that the securities would not be settled at a price less than the amortized cost

of the Company’s investment. The Company evaluated the underlying credit quality of the issuers and the credit

ratings of the state and municipal obligations and the corporate obligations, noting neither a significant

deterioration since purchase nor other factors leading to an other-than-temporary impairment (OTTI). The

unrealized losses on mortgage-backed securities as of December 31, 2009 were primarily caused by higher

interest rates in the marketplace, reflecting the higher perceived risk assigned by fixed-income investors to

commercial mortgage-backed securities (CMBS). These unrealized losses represented less than 1% of the total

amortized cost of the Company’s mortgage-backed security holdings as of December 31, 2009. The Company

believes these losses to be temporary. Approximately 94% of the Company’s mortgage-backed securities in an

unrealized loss position as of December 31, 2009 were rated “AAA” with no known deterioration or other factors

leading to an OTTI. As of December 31, 2009, the Company did not have the intent to sell any of the securities in

an unrealized loss position.

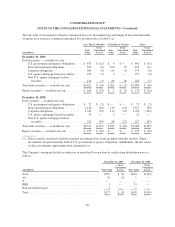

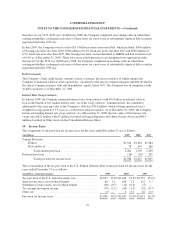

As of December 31, 2009, the Company’s holdings of non-U.S. agency mortgage-backed securities included $10

million of commercial mortgage loans in default. These investments were acquired in the first quarter of 2008

pursuant to an acquisition and were recorded at fair value. They represented less than 1% of the Company’s total

mortgage-backed security holdings as of December 31, 2009.

A portion of the Company’s investments in equity securities and venture capital funds consists of investments

held in various public and nonpublic companies concentrated in the areas of health care delivery and related

information technologies. Market conditions that affect the value of health care and related technology stocks

will likewise impact the value of the Company’s equity portfolio. The equity securities and venture capital funds

were evaluated for severity and duration of unrealized loss, overall market volatility and other market factors.

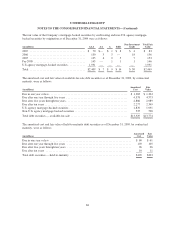

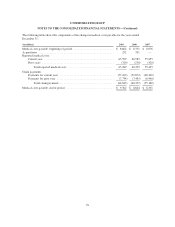

Net realized gains, before taxes, were from the following sources:

Year Ended December 31,

(in millions) 2009 2008 2007

Total OTTI ............................................................ $(64) $(121) $ (6)

Portion of loss recognized in other comprehensive income ...................... — n/a n/a

Net OTTI recognized in earnings ........................................... (64) (121) (6)

Gross realized losses from sales ............................................ (41) (50) (13)

Gross realized gains from sales ............................................ 116 165 57

Net realized gains (losses) ................................................ $ 11 $ (6) $38

For 2009, all of the recorded OTTI resulted from the Company’s intent to sell certain impaired securities.

70