United Healthcare 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

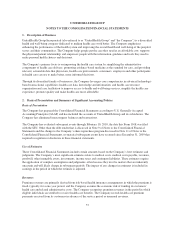

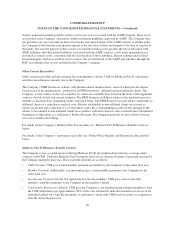

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

December 31, 2008, the Company had an aggregate $2.0 billion reinsurance receivable, of which $154 million

was recorded in Other Current Receivables and $1.9 billion was recorded in Other Assets in the Consolidated

Balance Sheets. The Company evaluates the financial condition of the reinsurer and only records the reinsurance

receivable to the extent of probable recovery.

Policy Acquisition Costs

The Company’s commercial health insurance contracts typically have a one-year term and may be cancelled by

the customer with at least 31 days notice. Costs related to the acquisition and renewal of commercial customer

contracts are charged to expense as incurred.

Share-Based Compensation

Share-based compensation expense is measured at the grant date based on the fair values of the awards and is

recognized as expense over the period in which the share-based compensation vests.

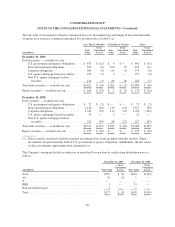

Net Earnings Per Common Share

The Company computes basic net earnings per common share by dividing net earnings by the weighted-average

number of common shares outstanding during the period. The Company determines diluted net earnings per

common share using the weighted-average number of common shares outstanding during the period, adjusted for

potentially dilutive shares associated with stock options and restricted stock, using the treasury stock method.

The treasury stock method assumes exercise of stock options and vesting of restricted stock, with the assumed

proceeds used to purchase common stock at the average market price for the period. The difference between the

number of shares assumed issued and number of shares assumed purchased represents the dilutive shares.

Recent Accounting Standards

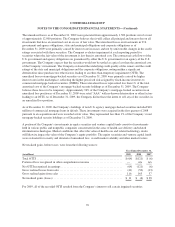

Recently Adopted Accounting Standards. In June 2009, the Financial Accounting Standards Board (FASB)

issued Statement of Financial Accounting Standards (FAS) No. 168, “The FASB Accounting Standards

Codification and the Hierarchy of Generally Accepted Accounting Principles — a replacement of FAS 162.” The

new standard establishes only two levels of U.S. GAAP, authoritative and nonauthoritative. The FASB

Accounting Standards Codification (ASC) became the single source of authoritative, nongovernmental U.S.

GAAP, except for rules and interpretive releases of the SEC, which will continue to be sources of authoritative

U.S. GAAP for SEC registrants. All other non-grandfathered, non-SEC accounting literature not included in the

ASC became nonauthoritative upon adoption. The new guidance became effective for the Company’s third

quarter of 2009. Since the new standard did not change U.S. GAAP, there was no change to the Company’s

Consolidated Financial Statements other than to update all references to U.S. GAAP to be in conformity with the

ASC.

The Company adopted the provisions of ASC Topic No. 820, “Fair Value Measurements and Disclosures”

(ASC 820) as of January 1, 2008 for fair value measurements of certain financial assets and liabilities and for

non-financial assets and liabilities measured at fair value on at least an annual basis. The provisions were adopted

for non-financial assets and liabilities not measured at fair value on at least an annual basis as of January 1, 2009.

These provisions define fair value, establish a framework for measuring fair value and expand disclosure

requirements. The adoption did not have a material impact on the Consolidated Financial Statements.

In December 2007, the FASB issued guidance codified into ASC Topic No. 805, “Business Combinations,”

which replaced previous business combination accounting guidance. The new guidance revises how an acquirer

64