United Healthcare 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

15. Commitments and Contingencies

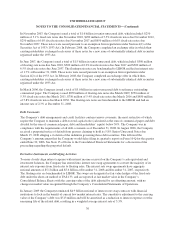

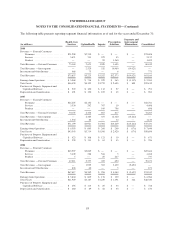

The Company leases facilities, computer hardware and other equipment under long-term operating leases that are

noncancelable and expire on various dates through 2028. Rent expense under all operating leases for 2008, 2007

and 2006 was $264 million, $223 million and $209 million, respectively. At December 31, 2008, future

minimum annual lease payments, net of sublease income, under all noncancelable operating leases were as

follows:

(in millions)

Future Minimum

Lease Payments

2009 ......................................................................... $258

2010 ......................................................................... 230

2011 ......................................................................... 195

2012 ......................................................................... 174

2013 ......................................................................... 129

Thereafter .................................................................... 688

In conjunction with the PacifiCare acquisition the Company committed to make $50 million in charitable

contributions for the benefit of California health care consumers, which has been accrued in its Consolidated

Balance Sheets. The Company has committed to specific projects totaling approximately $30 million of the $50

million charitable commitment at December 31, 2008, of which $21 million was paid. Additionally, the

Company agreed to invest $200 million in California’s health care infrastructure to further health care services to

the underserved populations of the California marketplace, of which $87 million was invested at December 31,

2008. The timing and amount of individual contributions and investments are at the Company’s discretion

subject to the advice and oversight of the local regulatory authorities; however, the Company’s goal is to have

the investment commitment fully funded by the end of 2010. The investment commitment remains in place for

20 years after funding.

The Company contracts on an administrative services only (ASO) basis with customers who fund their own

claims. The Company charges these customers administrative fees based on the expected cost of administering

their self-funded programs. In some cases, the Company provides performance guarantees related to its

administrative function. If these standards are not met, the Company may be financially at risk up to a stated

percentage of the contracted fee or a stated dollar amount. Amounts accrued for performance guarantees were not

material at December 31, 2008 and 2007.

At December 31, 2008, the Company has outstanding, undrawn letters of credit with financial institutions of

approximately $60 million and surety bonds outstanding with insurance companies of approximately $300

million, primarily to bond contractual performance.

Legal Matters

Legal Matters Relating to Historical Stock Option Practices

Regulatory Inquiries. In March 2006, the Company received an informal inquiry from the SEC relating to its

historical stock option practices. On December 19, 2006, the Company received from the SEC staff a formal

order of investigation into the Company’s historical stock option practices. On December 22, 2008, the Company

announced it had reached an agreement to settle the SEC’s investigation. Without admitting or denying the

SEC’s allegations, the Company agreed to a permanent injunction against any future violations of certain

86