United Healthcare 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will not be

realized. The valuation allowances primarily relate to future tax benefits on certain state net operating loss

carryforwards. Federal net operating loss carryforwards of $82 million expire beginning in 2012 through 2028,

and state net operating loss carryforwards expire beginning in 2009 through 2028.

The Company adopted the provisions of FIN 48 on January 1, 2007. The cumulative effect of adopting FIN 48

for the first quarter of 2007 resulted in an increase to its liability for unrecognized tax benefits of $88 million,

which included a reduction of $61 million in retained earnings and an increase of $26 million in goodwill. The

total amount of unrecognized tax benefits as of the date of adoption was $341 million. A reconciliation of the

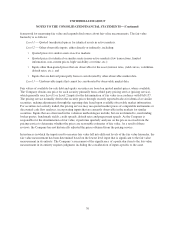

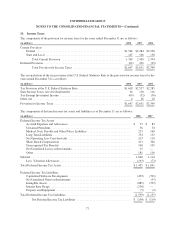

beginning and ending amount of unrecognized tax benefits as of December 31 is as follows:

(in millions) 2008 2007

Gross Unrecognized Tax Benefits, Beginning of the Period ............................... $271 $ 341

Gross Increases:

Current Year Tax Positions .................................................... 14 23

Prior Year Tax Positions ...................................................... 43 26

Acquired Reserves ........................................................... 94 —

Gross Decreases:

Prior Year Tax Positions ...................................................... (29) (31)

Settlements ................................................................. (4) (87)

Statute of Limitations Lapses .................................................. (49) (1)

Gross Unrecognized Tax Benefits, End of the Period .................................... $340 $ 271

The Company classifies interest and penalties associated with uncertain income tax positions as income taxes

within its Consolidated Financial Statements. During the years ended December 31, 2008 and 2007, the

Company recognized $23 million and $28 million of interest expense, respectively. The Company had

approximately $65 million and $54 million of accrued interest, respectively, at December 31, 2008 and 2007,

which were reported in Accounts Payable and Accrued Liabilities in the Consolidated Balance Sheets. These

amounts are not included in the reconciliation above. As of December 31, 2008, the total amount of unrecognized

tax benefits that, if recognized, would affect the effective tax rate was $193 million.

The Company currently files income tax returns in the U.S. federal jurisdiction, various states, and foreign

jurisdictions. The U.S. Internal Revenue Service (IRS) has completed exams on the consolidated income tax

returns for fiscal years 2007 and prior. The Company’s 2008 tax return is under advance review by the IRS under

its Compliance Assurance Program (CAP). With the exception of a few states, the Company is no longer subject

to income tax examinations prior to 2002 in major state and foreign jurisdictions. The Company does not believe

any adjustments that may result from these examinations will be significant.

The Company believes it is reasonably possible that its liability for unrecognized tax benefits will decrease in the

next twelve months by $138 million or less as a result of audit settlements and the expiration of statutes of

limitations in certain major jurisdictions.

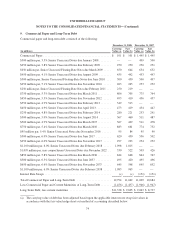

11. Shareholders’ Equity

Regulatory Capital and Dividend Restrictions

The Company conducts a significant portion of its operations through subsidiaries that are subject to regulations

and standards established by their respective states of domicile. Most of these regulations and standards conform

78