United Healthcare 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

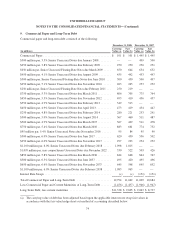

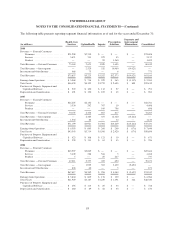

The following AARP Program-related assets and liabilities were included in the Company’s Consolidated

Balance Sheets at December 31:

(in millions) 2008 2007

Accounts Receivable ........................................................... $ 482 $ 459

Assets Under Management ...................................................... 2,199 2,176

Other Assets ................................................................. 7 —

Medical Costs Payable ......................................................... 1,160 1,109

Accounts Payable and Accrued Liabilities .......................................... 52 33

Other Policy Liabilities ......................................................... 1,047 1,132

Future Policy Benefits .......................................................... 429 —

Unearned Premiums ........................................................... — 361

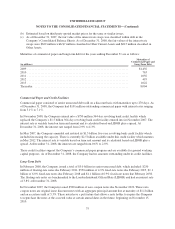

At December 31, 2008, the fair value of cash, cash equivalents and investments associated with the Program,

included in Assets Under Management, and the fair value of Other Assets were classified in accordance with the

fair value hierarchy as discussed in Note 5 of Notes to the Consolidated Financial Statements and were as

follows:

(in millions)

Quoted Prices

in Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Total Fair

Value

Cash and Cash Equivalents ........................... $240 $ 18 $— $ 258

Debt Securities:

U.S. Government and Direct Agency obligations ...... 291 293 — 584

State and Municipal obligations ................... — 6 — 6

Corporate obligations ........................... — 786 — 786

Mortgage-backed securities (a) .................... — 563 — 563

Total Debt Securities ................................ 291 1,648 — 1,939

Equity Securities — Available-for-Sale ................. — 2 — 2

Total Cash and Investments ........................... 531 1,668 — 2,199

Other Assets ....................................... — — 7 7

Total Assets at Fair Value ............................ $531 $1,668 $ 7 $2,206

(a) Includes Agency-backed mortgage pass-through securities.

84