United Healthcare 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

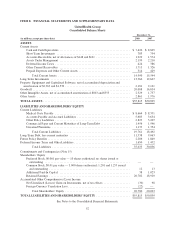

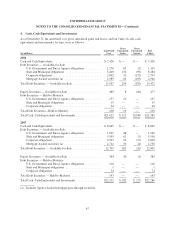

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

reporting period, the Company’s operating results include the effects of more completely developed medical

costs payable estimates associated with previously reported periods.

Cash, Cash Equivalents and Investments

Cash and cash equivalents are highly liquid investments that have an original maturity of three months or less.

The fair value of cash and cash equivalents approximates their carrying value because of the short maturity of the

instruments.

During the fourth quarter of 2008, the Company changed its intent with respect to offsetting cash balances,

which affected its balances in checks outstanding in excess of bank deposits for certain cash balances. As of

December 31, 2008, the Company had checks outstanding in excess of bank deposits of $1.2 billion, which

were reclassified from Cash and Cash Equivalents to Accounts Payable and Accrued Liabilities in the

Consolidated Balance Sheets and have been reflected as Checks Outstanding in the Consolidated Statements

of Cash Flows. There were no checks outstanding in excess of bank deposits as of December 31, 2007.

Investments with maturities of less than one year are classified as short-term. Because of regulatory

requirements, certain investments are included in long-term investments regardless of their maturity date. The

Company classifies these investments as held-to-maturity and reports them at amortized cost. Substantially all

other investments are classified as available-for-sale and reported at fair value based on quoted market prices,

where available.

The Company excludes unrealized gains and losses on investments in available-for-sale securities from earnings

and reports them, net of income tax effects, as a separate component of shareholders’ equity. The Company

continually monitors the difference between the cost and estimated fair value of its investments. For those

investments in an unrealized loss position, the Company analyzes relevant factors individually and in

combination including the length of time and extent to which market value has been less than cost, the financial

condition and near-term prospects of the issuer as well as specific events or circumstances that may influence the

operations of the issuer, and the Company’s intent and ability to hold the investment for a sufficient time to

recover its cost. New information and the passage of time can change these judgments. The Company revises

impairment judgments when new information becomes known or when it does not anticipate holding the

investment until the forecasted recovery. If any of the Company’s investments experience a decline in value that

is determined to be other-than-temporary, based on analysis of relevant factors, the Company records a realized

loss in Investment and Other Income in its Consolidated Statements of Operations. The amortization of

premiums and accretion of discounts are recorded utilizing the effective yield (interest) method, over the period

from the date of purchase to maturity or call date, whichever produces the lowest yield. For asset-backed

securities included in debt securities, the Company recognizes income using an effective yield based on

anticipated prepayments and the estimated economic life of the securities. When estimates of prepayments

change, the effective yield is recalculated to reflect actual payments to date and anticipated future payments. The

net investment in the securities is adjusted to the amount that would have existed had the new effective yield

been applied since the acquisition of the securities. These adjustments are reflected in Investment and Other

Income in the period of change. The Company manages its investment portfolio to limit its exposure to any one

issuer or market sector, and largely limit its investments to U.S. Government and Agency securities, state and

municipal securities, asset-backed, and corporate debt obligations, all of investment grade quality. If securities

are downgraded below policy minimums, subsequent to purchase, they will be disposed of in accordance with the

investment policy. To calculate realized gains and losses on the sale of investments, the Company uses the

specific cost or amortized cost of each investment sold.

58