United Healthcare 2008 Annual Report Download - page 56

Download and view the complete annual report

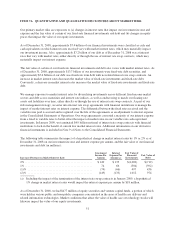

Please find page 56 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.agreements that are cancelable without penalty and also excludes liabilities to the extent recorded in our

Consolidated Balance Sheets as of December 31, 2008.

(d) Estimated payments required under life and annuity contracts held by a divested entity. Under our

reinsurance arrangement with OneAmerica Financial Partners, Inc. (OneAmerica) these amounts are

payable by OneAmerica, but we remain liable to the policyholders if they are unable to pay. We have

recorded a corresponding reinsurance receivable from OneAmerica in our Consolidated Financial

Statements.

(e) Unrecognized tax benefits relate to the provisions of Financial Accounting Standards Board (FASB)

Interpretation No. 48 (FIN 48). Since the timing of future settlements is uncertain, the long-term portion has

been classified as “Thereafter.” See Note 10 of Notes to the Consolidated Financial Statements for more

detail.

(f) Includes remaining capital commitments for venture capital funds and the investment commitment related to

the PacifiCare acquisition. See Note 15 of Notes to the Consolidated Financial Statements for more detail.

(g) Includes future payments to optionholders related to the application of Section 409A, as well as obligations

associated with certain employee benefit programs and charitable contributions related to the PacifiCare

acquisition discussed below, which have been classified as “Thereafter” due to uncertainty regarding

payment timing.

We do not have other significant contractual obligations or commitments that require cash resources; however,

we continually evaluate opportunities to expand our operations. This includes internal development of new

products, programs and technology applications, and may include acquisitions.

OFF-BALANCE SHEET ARRANGEMENTS

We do not participate or knowingly seek to participate in transactions that generate relationships with

unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special

purpose entities (SPEs), which would have been established for the purpose of facilitating off-balance sheet

arrangements or other contractually narrow or limited purposes. As of December 31, 2008, we were not involved

in any SPE transactions.

RECENTLY ISSUED ACCOUNTING STANDARDS

In April 2008, the FASB issued FASB Staff Position FAS 142-3, “Determination of the Useful Life of Intangible

Assets” (FSP 142-3). FSP 142-3 amends the factors to be considered in developing renewal and extension

assumptions used to determine the useful life of a recognized intangible asset accounted for under FAS No. 142,

“Goodwill and Other Intangible Assets.” FSP 142-3 is effective for our fiscal year 2009 and must be applied

prospectively to intangible assets acquired after January 1, 2009. Early adoption is not permitted. We do not

expect the adoption of FSP 142-3 will have a material impact on our Consolidated Financial Statements.

In December 2007, the FASB issued FAS No. 141 (Revised 2007), “Business Combinations” (FAS 141R), which

replaces FAS No. 141, “Business Combinations.” FAS 141R establishes principles and requirements for how an

acquirer recognizes and measures in our financial statements the identifiable assets acquired, the liabilities

assumed, any noncontrolling interest in the acquiree and the goodwill acquired. The statement also establishes

disclosure requirements that will enable users to evaluate the nature and financial effects of the business

combination. FAS 141R is effective for our fiscal year 2009 and must be applied prospectively to all new

acquisitions closing on or after January 1, 2009. Early adoption of this standard is not permitted. We do not

expect the adoption of FAS 141R will have a material impact on our Consolidated Financial Statements.

In December 2007, the FASB issued FAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements — An Amendment of ARB No. 51” (FAS 160). FAS 160 requires that accounting and reporting for

minority interests be recharacterized as noncontrolling interests and classified as a component of equity. The

46